Credit card surcharges, checkout fees, merchant surcharges – whatever you call them, the concept is the same: you add a fee when a customer uses a credit card. But are they legal? And more importantly, are they a good idea for your business?

To answer those questions, we’ll explore all aspects of what surcharging entails.

- What is Surcharging?

- Surcharging History

- Fast Facts on Credit Card Surcharges

- Surcharge Basics

- State-Specific Rules

- Pros and Cons of Credit Card Surcharges

- How to Get Started

- The Don’ts of Surcharging Cards

- Alternatives to Surcharging

What is Surcharging?

Simply put, credit card surcharging means adding a fee to the total transaction price when a customer pays with a credit card instead of another method. (Such as cash, check, or debit card.) The fee is a percentage of the total and subject to a cap set by the card brands. This cap can be superseded by state law.

The surcharge is added at the point of sale and increases the total amount due by the customer. For example, if your business imposes a 4% surcharge (the maximum allowed in most states), a customer purchasing a $10 item with a credit card would pay $10.40. (4% of $10 = $0.40.)

Surcharging History

Surcharging has not always been permitted. Prior to 2013, it was prohibited by the card brands – specifically Visa and Mastercard – because the companies didn’t want to dissuade customers from using their credit cards. Visa and Mastercard have always prohibited these fees as part of their merchant agreements; Discover and American Express allowed them, but forbade businesses to surcharge their cards differently than any other brands. So, unless a business only accepted Discover and American Express, surcharges were off the table.

A 2013 class action lawsuit against Visa and Mastercard resulted in a settlement allowing businesses to charge customers a fee for using credit cards. This fee is now commonly referred to as a “merchant surcharge, “surcharge,” or “checkout fee.” The latter name has fallen out of favor but may still be seen in some locations.

In 2017, the United States Supreme Court heard a case involving the legality of surcharging in the state of New York. Lower courts had upheld the state’s ban on surcharging credit cards. However, the Supreme Court ruled that the New York law regulated speech, not business conduct, potentially making the law unconstitutional, and remanded it to the lower courts to specifically review in terms of free speech.

In 2019, the State of New York and plaintiffs reached an agreement to dismiss the case, a move that allowed New York businesses to begin surcharging, provided that businesses disclosed the fees to customers in dollars and cents.

The case was seen as a watershed moment for surcharging, with legal experts and industry insiders predicting widespread ability to surcharge in the following years.

The class action settlement and the New York case allowed businesses to reduce the impact of credit card processing fees by instead passing those costs on to consumers. However, there are many rules businesses must follow in order to charge those fees, as well as pros and cons that should be considered before deciding if surcharging is the right move.

Update, 2023: As reported by Payment Dive, in spring 2023, Visa announced that it was lowering the surcharge cap from 4% to 3% (or the actual cost of processing, whichever is lower.) Representatives for the company have referred to surcharging as “not great” for the customer experience. At the time of this update, Mastercard’s cap is still set at 4% or the actual cost of processing, whichever is lower. As the Payment Dive article notes, some question Visa’s legal authority to alter the cap, but so far no challenges have been brought in court.

Fast Facts on Credit Card Surcharges

- Surcharges are legal in most states

- Adding fees not against merchant agreements; the card brands allow surcharging.

- Surcharges are prohibited in Connecticut and Massachusetts

- States with surcharge laws being challenged in court, or states with special laws surrounding surcharging, include California, Colorado, Maine, New York, and Texas

- Where legal, surcharges are only allowed on credit cards, NOT debit cards

- Surcharges are capped at 3% (for Visa), 4% (for Mastercard) or the “actual cost of processing,” whichever is lower, except in Colorado, where the cap is 2%

- Businesses must inform customers of the surcharge before checkout

- Surcharges and cash discounts are not the same thing

**Recently, non-compliant cash discount programs have cropped up that are in violation of Visa’s surcharging rules. Read more about cash discounts (and how to determine if the program you’re considering is compliant) in our article about credit card cash discounts. **

**State laws are constantly evolving on the topic of credit card surcharges. We regularly update this article and do our best to maintain the accuracy of surcharge laws, but it’s a good idea to check with your state’s Attorney General or a business lawyer for the latest on surcharge legalities before implementing a surcharge.**

Surcharge Basics

As you consider whether or not surcharging is right for your business, start by familiarizing yourself with some essential information — the difference between checkout fees (surcharges) and convenience fees, the states where surcharging is currently banned, and the procedures you must follow in order to start surcharging.

Surcharges vs. Convenience Fees

Even before the Visa & Mastercard settlement, businesses were allowed to charge their customers convenience fees for using credit cards in a very limited set of situations. These fees are meant to be used when paying with a credit card is a “bona fide” convenience over other forms of payment — for example, if the only other option for the customer would be a money order. Unlike surcharges, convenience fees are a flat amount, not a percentage.

Most transactions — including any transaction that is face-to-face, and any transaction done over the phone or online if that is the only method of payment available — fall outside the definition of a convenience fee. CardFellow has an excellent guide to convenience fees, and the rules for these have not changed.

However, a surcharge does not have to meet the requirements that a convenience fee does. Instead, it is applied to any credit card transaction as a cost of using that card. This applies to all four of the major card brands – Visa, Mastercard, Discover, and American Express.

There are limits on what merchants can charge and conditions that merchants must meet in order to surcharge credit card transactions — the next part of this article will explore these in depth.

States Where Surcharging is Banned

As of autumn 2022, there are only two states remaining where surcharging is explicitly prohibited: Connecticut and Massachusetts. If your business operates in either of those states, you may not charge credit card fees to your customers.

Several states still have anti-surcharge laws on the books, but they are being challenged in court or are currently unenforceable. Those states include California, Texas, and Utah.

On the other side of the coin, several states are considering or have pending legislation that would make surcharging illegal if passed. Those states include Hawaii, Illinois, New Jersey, and Rhode Island. Many experts believe it is unlikely that new bans on surcharges would actually go into effect due to successful court challenges to surcharging in other locations.

If you do business in multiple states, you may surcharge credit card transactions only in states where it is permitted.

State-Specific Rules

Several states have their own rules (or court challenges) surrounding credit card surcharging. We’ve included information on those states and their specifics below, but be aware that the legal landscape in these states may shift quickly. It’s a good idea to consult a business attorney prior to implementing a surcharge program if you’re in a state dealing with surcharging grey area such as those listed below.

California

While California once prohibited surcharging, court challenges called the ban into question. In 2018, courts in the state of California ruled that the ban on surcharges was unconstitutional as it placed restrictions on business’ speech.

Jonathan Razi, Founder and CEO of payment processing company CardX and graduate of Harvard Law School, explains, “The Ninth Circuit decision means that the California surcharge ban is unconstitutional as applied to these plaintiffs and the specific pricing practice they’re looking to employ: a single sticker price with a percentage fee added when customers choose credit cards.”

Razi clarifies that the ruling does not apply to pricing that was not included in this case, such as dual-sticker pricing. But businesses that want to use the same single-sticker pricing that was challenged in this case would be able to do so in order to clearly communicate the cost of accepting credit cards.

“Part of what we see in this decision’s set of facts, which any solution that complies with the card brand rules would do, is using signage to adequately disclose the credit card surcharge. In fact, a major interest behind this First Amendment challenge is that these merchants want to communicate very clearly about the high cost of credit card acceptance. If another merchant strayed from making these clear disclosures, and instead misled or surprised customers, then they may face a legitimate enforcement of the California law. To California merchants, we’re saying that, if your pricing plan matches what these plaintiffs are doing, then this decision is authoritative and controlling.”

CardX and other processors that offer automatic surcharging in states where permitted can serve businesses in California as a result of the legal case.

However, businesses may be required to list both the credit and cash prices in dollars and cents. On its website, CardX shows examples of what this may look like, as seen below:

CardX shows an example of a shelf sticker, an invoice, and example wording in a verbal exchange that would satisfy the disclosure requirements when surcharging credit cards.

Keep in mind that California has laws that still apply regarding deceptive pricing, so you may want to consult an attorney if you’re considering imposing a credit card surcharge on a business operating in California to ensure you comply with the recent decision and all applicable laws.

Colorado

While Colorado does allow surcharging, it has a more restrictive cap on the fees a business can charge. Colorado businesses can only add a fee up to 2% or the actual cost of processing, whichever is lower.

New Jersey

Like other states, New Jersey allows surcharging, but as of August 2023, it caps the surcharge to limit profiting from it. The law states that businesses must post notices about the surcharge and caps the surcharge at the cost of processing the transaction. Technically, according to Visa and Mastercard rules, businesses should already be limiting the surcharge to their actual cost of processing (or not more than 3% for Visa or 4% for Mastercard.) This law simply enforces that and gives the state of New Jersey the ability to pursue action against businesses that profit from surcharges.

New York

The New York challenge regarding surcharges was one of the more well-publicized, in part due to its escalation. In 2017, the Supreme Court heard a case regarding the legality of surcharging in the state of New York. Lower courts had upheld New York’s ban on surcharging credit cards. The case, Expressions Hair Design v. Schneiderman, was heard in January of that year, with the SCOTUS weighing in during early April.

The Supreme Court stated that the New York law regulates speech, not business conduct, which could potentially make the law unconstitutional. The Supreme Court remanded the case to lower courts, who reviewed it specifically in terms of free speech.

In early January 2019, the State of New York and the plaintiffs reached an agreement to dismiss the case. Dismissal allowed New York businesses to pass credit card fees to customers provided that business makes a disclosure to the consumer showing the credit price in dollars and cents.

Razi, who authored CardX’s amicus brief in the Expressions Hair Design Supreme Court case, explains that he, “Expect[s] the New York law will survive, but in a far narrower form—and ‘no surcharge’ will simply mean ‘no surprise.’ Now, New York merchants are allowed to pass on their credit card fees so long as they make the required consumer disclosure.”

Maine

Like New York and California, Maine allows surcharging but requires specific disclosure. If you’re a Maine business and looking to surcharge, you’ll need to post the cost for both paying with cash and paying with a credit card so that customers are clear on their actual cost for an item.

Texas

As of 2018, Texas businesses can surcharge in most cases. In Rowell v. Paxton, the court determined that surcharging is considered protected speech under the First Amendment. Thus, the Court ruled Texas’ “no surcharge” law unconstitutional. However, there may be instances where surcharging is still not permissible.

The Texas State Law Library, a government website that serves the research needs of the Texas Supreme Court, Attorney General, and other legal agencies, has a page dedicated to the question of surcharging, but as of this update, it states that the question is complex.

It goes on to explain that surcharging may still be against the law in some instances. It references the 2018 Rowell v. Paxton case, where the ban on surcharging was deemed unconstitutional. However, the page then cites an opinion provided by the Attorney General in 2019 stating that the law is still enforceable in certain situations. The AG states:

“When a court determines that a statute is unconstitutional as applied, it normally invalidates the statute only as applied to the litigant in question and does not render the statute unenforceable with regard to other litigants or different factual circumstances. […] Thus, circumstances may still exist where, as applied, section 604A.0021 operates to prohibit a credit card surcharge fee.”

In this statement, the Attorney General is explaining that the court decision only applies to the party involved in the court case and that it does not mean the state ban on surcharges can never be enforced in other situations.

If you’re running a business in Texas and are considering surcharging, be sure to check with a licensed attorney in your state or consider a compliant cash discount program rather than a surcharge.

Pros and Cons of Credit Card Surcharges

Deciding to surcharge isn’t easy – there are pros and cons to doing so and you should carefully weigh the costs and benefits for your business.

The benefits are fairly straightforward:

- Surcharging can help your bottom line

It’s unlikely you’ll be able to completely eliminate your credit card processing costs by surcharging, but you can defray a large portion of them. A “heads up” – several industry insiders have predicted that processors will charge businesses the usual rate for any checkout fees added to transactions, so be aware that businesses that surcharge could actually see higher processing costs. - If processing costs are built in to your prices, it’s possible that surcharging will allow you to lower prices across the board. This, in turn, could make your business more competitive, especially if most of your customers pay with cash, check, or debit cards.

However, surcharging comes with several disadvantages that make it less appealing in some cases. Many large retail chains (including giants such as Home Depot and Walmart) have gone on record stating that they have no plans to start adding checkout fees, as they believe that doing so would drive away customers. You might consider NOT surcharging if:

- Most of your customers use credit cards.

Remember the principles of supply and demand – if you add a few percent to each transaction, customers who shop with credit cards may buy less. In addition, studies have repeatedly shown that consumers spend more with credit cards than with cash. Even if your customers switch, it’s very possible that they will spend less if they feel limited to the cash they carry in their wallet. - It’s easy to find alternatives to your business nearby.

If a consumer can get a similar product or service for the same price across the street, and that business doesn’t surcharge, why would they go to the one who does? - Your typical transactions are high dollar amounts.

Consumers likely won’t flinch over 3% added to a pack of gum; 3% added to the price of a TV is a different story. The more your goods or services cost, the more likely a surcharge will cause them to buy less – or not purchase from you at all. - You serve consumers who are particularly averse to surcharges.

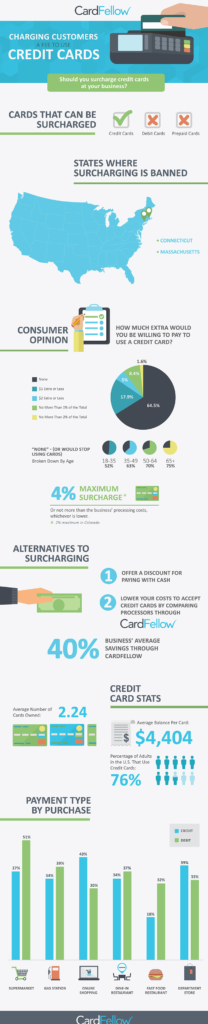

See our infographic on surcharging for more details on consumer opinions of credit card surcharging.

Before deciding whether or not to surcharge, consider those fees through the eyes of your customers and carefully consider whether those fees will make up for any loss in revenue.

How to Get Started

If you’re allowed by state law to charge a fee for using a credit card and you’ve decided it’s the right move for your business, here’s the process to get started:

Notification

- Notify the card brands you accept of your intent to surcharge.

Visa and MasterCard each have a form that businesses must fill out. This is Visa’s surcharge form. Mastercard provides information about disclosing intent to surcharge in their surcharging FAQ. Each brand requires 30 days notice before you may begin charging checkout fees. - Inform your acquiring bank of your intent to surcharge.

Different banks have different procedures; most require 30 days’ notice as well. Your merchant service provider will likely be able to tell you what needs to be done to meet this requirement.? - Decide what to surcharge.

You can choose whether you want to charge for only specific types of cards (such as rewards cards, which tend to carry higher costs for businesses) or for all cards issued under a brand. You must choose one or the other — you cannot charge a fee for all cards and an additional fee for card products which have higher processing costs.

Disclosure

- Both Visa and Mastercard require businesses to post a sign both at the main entrances to their business and at all points of sale notifying customers that their credit card purchases will be subject to checkout fees. The signs on entrances need to inform customers that you charge fees, while the point of sale signs must disclose the percentage that will be added to the transaction. Visa provides signage that you can print out and use.

- Online businesses have to let customers know about checkout fees on the first page of their website that references card brands

- Checkout fees need to appear as a separate item on receipts. In many cases, your merchant service provider will need to program your point of sale terminals to meet this requirement. Contact them with questions.

The “Don’ts” of Surcharging Cards

Both the court settlement and the card brands have outlined specific limits on surcharging in order to protect consumers. If you decide to surcharge, protect yourself from costly chargebacks or sanctions from your acquiring bank and the card brands by remembering the following:

- Don’t charge a fee greater than your actual credit card processing cost.

Visa and Mastercard base this on whatever your merchant discount rate was in the last quarter. - Don’t charge a fee higher than 4% of the transaction for Mastercard or 3% for Visa.

This limit is outlined in the surcharging settlement. - Don’t surcharge debit cards or prepaid cards.

These forms of payment are specifically excluded from the settlement. You cannot surcharge a debit card, even if it’s “run as credit.” - Don’t forget to let your customers know that you charge credit card fees.

The exact requirements set forth by the card brands are outlined earlier in this article. Your customers should always know what forms of payment you surcharge, as well as how much your surcharge, before they use their card. - Don’t keep surcharge fees when refunding customers.

When issuing refunds, you must also refund any surcharges – even for partial refunds. For example, if you refund 50% of a customer’s purchase, you need to refund 50% of the surcharge you collected.

Alternatives to Surcharging

Not sure that surcharging is the right answer? Consider these alternatives:

- Offer a cash discount

While it sounds – and is – similar, a cash discount is an option to “reward” customers who pay with cash rather than “penalizing” credit card customers with an added fee. You are allowed to offer a cash discount to customers that don’t pay with plastic. Many gas stations, for example, already engage in this practice. - Impose a minimum purchase amount

Businesses are allowed to set a minimum purchase up to $10 for credit card transactions. Setting a $10 minimum ensures a higher transaction amount, making it more worthwhile to eat the cost of credit card processing.

Note: You cannot impose minimums on debit card transactions.

Have you implemented credit card surcharges at your business? What do your customers think? Let us know in the comments!

Is it lawful to only charge surcharge fees when purchases are more than $1000?

Hi Jennie,

Generally surcharges would need to apply to any transaction amount, but we’re not able to give legal advice for individual situations. It’s best to contact an attorney with these type of specific questions.

Who would I complain to if a merchant is charging .50 a transaction for debit or credit on all amounts? For example, $5 charge will cost one 50 cents.

Hi Tracy,

I’d suggest talking to the merchant directly or contacting your Chamber of Commerce.

In addition to my last comment; this is in FL

My son was charged a service fee in Illinois for an elective cosmetic surgery that was 15% of his total charge. His walkout receipt showed $7300.00 for services rendered/paid in full via Care Credit, then they made him pay an additional $1095.00 on top of that via other payment methods…this isn’t legal is it?

Hi Lisa,

I can’t really advise about the legality of that situation, as we’re not lawyers and because I don’t know what the service charge is for (if it was charged as some miscellaneous service fee by the doctor or if it was explicitly a credit card surcharge, etc.) Your best bet would be to consult a lawyer or contact your state Attorney General. Good luck!

Rewards cards hit merchants very hard, with the average fee taken from the merchant being $30.00 not including the regular 3-4% fees.

Our business got hit last month with $255.00 in fees on just five charges.

That was $50.00 per transaction. The average invoice to the customer was $100.00

We received half.

We contacted our bank and processor and were told these charges we from the customers own credit cards and they had no control over it.

Be warned: Customer using REWARDS cards will not be paying you in full and you will lose your shirts by taking their cards.

Hi Chad,

While rewards cards can be a higher cost to process, it sounds like you may not have the most competitive processing solution unless you have unusual circumstances like a high risk business model.

Your processor generally does have some control over your total costs for processing, even with rewards cards. Who is your processor?

I’d strongly suggest checking out CardFellow’s free processing quote comparison tool. You’ll be able to get fully-disclosed quotes from multiple processors to review in private and have the opportunity to see what pricing is available for your business. You may find that you could be getting overcharged – the average business that chooses a processor through us saves 40% on processing costs. It only takes a few minutes. Go here to sign up or check out our video explanation of what we do.

For Texas it seems that the law has been updated.

http://occc.texas.gov/publications/credit-card-surcharges

See the Advisory Bulletin which links to the following:

http://occc.texas.gov/sites/default/files/uploads/misc/b15-2-credit-card-surcharge-alternatives-6-25-15.pdf

Hi Matt,

I’m not sure where you’re seeing that it’s been changed? The first link you posted clearly states that surcharging isn’t allowed in Texas, with this statement: “The Texas Finance Code prohibits sellers of goods and services from imposing a credit card surcharge. This means that a seller is not allowed to add an extra amount to the regular price of a good or service when the buyer pays by credit card, as opposed to some other payment method.”

The PDF you linked includes alternatives to surcharging, some of which we mentioned (such as offering a discount for cash payments or raising prices across the board) and some options that are not credit card surcharges, such as adding a service fee for all payment methods, or adding a convenience fee for certain types of transactions. (Such as online payments.) Convenience fees are different than surcharges, and have their own set of rules from the card brands, including the requirement of being a ‘bona fide’ convenience. We have an article on convenience fees here: https://webdevfolio.com/cardfellow_live_9102023/blog/charging-customers-a-credit-card-convenience-fee-at-check-out/

In New Jersey, what are the guidelines for charging these fees? As a merchant, we would like to explore the possibility, as our minimum “swipes” as a contractor are in the thousands, which costs us hundreds off of our bottom line. However, we want to do it “by the book”. In addition, I did read that the surcharge can be only on a credit card, not a debit card. How is that determined? Is it determined by whether or not a pin is used at the time of sale, or how the card is actually processed on the back end? Any help would be appreciated.

Hi Debi,

The guidelines are noted in the article above, starting with the section called “How to get Started.” You’ll need to notify Visa and MasterCard of your intent to surcharge at least 30 days in advance, determine if the fee will be on all Visa/MC cards or just certain ones (like only rewards cards, etc.), and provide appropriate notification to your customers before each surcharge. Additionally, the surcharge will need to be a separate line item on receipts. The amount must be the actual cost of processing or not more than 4%, whichever is lower. You’re correct that it can only be applied to credit cards, not debit cards.

I hope this helps!

The store that I work at suddenly got a memo today from the owners telling us to stop doing the credit card surcharge (2% for Visa and MasterCard, 3% for Amex) and to not tell anyone we had been… Were we doing something illegal?

Hi Holly,

It depends on the state you’re in (9 states have laws prohibiting surcharges.) Other than those states, it may not have been illegal, but it could still have been outside of Visa and MasterCard’s regulations, depending on how it was set up and other details.

If a customer uses a debit card, but does NOT enter their PIN (in other words, they use it like a credit card, even though it is a debit card), may we charge them a surcharge in this case?

Unfortunately no. A debit card is always a debit card, regardless of how it’s processed. You’re not able to surcharge debit cards whether they’re PIN debit or signature debit.

We order merchandise over the phone and pay by a debit card and are charged 2%. We are in Georgia. Is this legal? They call it a (2% credit card surcharge).

It’s probably legal because Georgia doesn’t have rules about surcharging, but we’re not able to give specific legal advice. It may potentially be against Visa and MasterCard’s agreements, as they prohibit surcharges on debit. However, convenience fees are subject to different rules than surcharges, and phone orders may fall under convenience fees. You can contact your state Attorney General for assistance in Georgia specifically.

The average consumer does not understand that it is the merchant that has to pay these out of control credit card processing fees month after month. The consumer and the merchant servicers / banks are the ones that are reaping the benefits of credit card usage and it is the local small business owners that are suffering because of it. It is for the consumers’ convenience yet the AMEX and MC & VISA companies look like the good guys because they offer rewards, etc. but the merchant is actually paying for it. Do small businesses a favor: GO GREEN, USE CASH!!!

Hi,

Our processor charges us 30 cents per transaction plus the processing fee plus $19.95/mo. Based on that information are we able to charge all credit cards (not debit) a 30 cent fee? And should this be labeled on the receipt a convenience fee, surcharge fee, or card processing fee?

Hi Jon,

It depends on a few other factors, notably what state you’re in. (Some states prohibit adding fees.) If you’re not in one of those states, you may be able to surcharge, and it would need to be listed as a credit card surcharge. There are a bunch of rules about surcharging, though, so it’s best to contact your processor, as well as Visa and MasterCard. (You’ll need to inform them that you intend to surcharge.)

Hi! I have 2 questions regarding this topic.

#1) My daughter just moved into a rental house and went to the city’s government building to have her account setup for water, garbage, etc. When she had inquired over the phone what the cost of the setup would be, she was told $50. When she arrived, they charged her an additional $1.75 to process her debit card payment. This is in Texas. Is it legal to charge a processing fee if the company is with the government?

#2) I work with apparel vendors in my area, which is Dallas, TX. They have locations across the country. If I use a “card” to make a payment online for an order, I am charged a 3.5% fee. If a fee cannot be charged in the State of Texas, how do they get away with charging it? Is it because they have locations in states where the law allows for the fees to be charged?

Thanks! Dee

Hi Dee,

For the government one, rules may be a little different. You’ll want to check with your state’s attorney general’s office. For the vendors, it’s possible that they’re applying a convenience fee, which is different than a surcharge and may be permissible in some instances. You could also pose that question to the attorney general for specifics for Texas. I hope this helps!

Went to dinner the other night in upstate New York and was charged a fee to use a Visa Debit Card. The ticket had a cash/AMEX price then had a MC/Visa price that they had added a fee to. Can they do that?

Fees to use a debit card are never permitted. Cash discounts are allowed.

We are a small business and have credit and check sales. Mass is listed as one of the states that you cannot charge a surcharge for. Most of our business is out of Mass, some in Maine and some in NH. Our actual office is out of NH and cards are processed in our office setting, mostly over the phone. For the businesses in Mass are we not allowed to do a surcharge fee even though our office is located in NH, which allows us to do it?

Generally it would follow the regulations for where the transaction takes place, but for something like that, you’ll want to check with your state Attorney General’s office.

Hi, I live in Texas, days ago I went on vacation trip to Mexico and paid all my expenses with my VISA debit card. When I come back I found out that I was charged 3% in all my expenses. It said “Foreign Debit/ATM Transaction Fee”, I call my bank and they say is VISA and VISA said is my bank…what is the real thing?

Thanks!

Probably your bank. Usually foreign debit/atm fees would be charged by the bank that issued the card. I hope this helps!

I when into a store today to buy 4 concert tickets at $60 each for a total of $240. I was about to pay and the lady refused to take my Visa debit card as a payment. She told me to go get cash and to come back. I ask why and she said cause they get charge for me to pay with the card.

Is that legal? To not take my visa debit card as payment?

Probably. Private stores aren’t required to take any particular form of payment – it’s at their discretion, subject to state and federal laws. For more exact info on your specific situation, you’d need to check your state laws or ask your state Attorney General’s office.

We are a business who provides services to other businesses, not to consumers. We have several customers who are now using “e-payments” to send us one-time use credit cards to pay invoices. We would like to pass along the processing fee to these customer, broken out in advance on the invoice, if they pay by credit card. (We’d need to know they were going to pay by credit card, but typically they’ve alraedy set this up in advance.)

Do these laws for credit card surcharging apply to businesses using credit cards for payment (corporate cards) or just to consumers?

The surcharging rules apply any time a credit card is accepted for payment. If you have specific questions on legalities, it’s always a good idea to consult a licensed attorney.

I have a question, I own a small business in California and this article was extremely helpful. I just opened this past April 2016, and was not too sure on whether or not to apply a service charge on credit/debit card transactions. Now I know I shouldn’t, but what can I say or do other than say I give a discount for using cash so that customers pay for using my terminal? Or would that be considered illegal? I just want to be honest with my customers. Thanks!

Hi Janette,

In California, you’re a bit limited. Your options are to offer the cash discount, or to raise the retail price of goods/services to cover the processing fees. This doesn’t directly help with the surcharging, but definitely also make sure you’re paying as little as possible for processing so that it’s not as much of a bite out of your bottom line. You can always use the price comparison tool at CardFellow (free and no obligation) to see what your pricing could be and how close it is to your current processing fees. You can try it here if you’re interested: https://www.cardfellow.com/sign-up.

Can a moving company in NYC charge 3% if customer is paying with a credit card?

Hi Shoshana,

New York prohibits surcharging credit cards, though other forms of fees (like convenience fees) may be acceptable. If you have questions about charges from a specific company, it’s best to contact your state’s attorney general with questions. Good luck!

What are the penalties or repercussions to a merchant over charging (above 4%) for using credit cards?

They charge a flat fee, $1.50 for credit and $1 for debit. Their average sale is probably about $5 to $10.

It varies by state and/or card brand. Debit cards cannot be surcharged.

I sell terminals to merchants in my state of New Jersey. I just lost 3 merchant accounts to another company because that company charged a 4% service fee for all of his credit card transactions. Is charging a 4% surcharge to customers in NJ legal or illegal? i would appreciate a reply from you.

Thank you for your cooperation.

Per our post, New Jersey does not prohibit surcharges. A surcharge of 4% or the actual cost of processing (whichever is lower) is permissible.

My company is deducting the surcharge amount from my commissions. Not surcharging the credit card user – 100% of my customers are credit card users.

Hi Kathleen,

That sounds similar to the concept of restaurants taking the processing fee out of servers’ tips. We have an article about that here: https://webdevfolio.com/cardfellow_live_9102023/blog/employers-deduct-credit-card-processing-fees-from-tips/

Hi,

We are in Kansas whole selling products to our dealers throughout the country. Right now we are planning to add additional 3% on the invoices we issued to our dealer already if they chose to pay us by credit card later on. We thought we should be ok as we are invoicing them and they agreed to pay this 3% on the revised invoices. Appreciate that if you could give some hints whether it is ok to do in this way in KS.

Hi Kevin,

Kansas typically prohibits surcharging credit card transactions. In some cases, convenience fees (different than surcharges) may be permissible, but I’d suggest consulting a business attorney familiar with Kansas law.

I am in Florida, and a company is charging a whopping $16 processing fee to pay for my monthly housing dues. What do I do, since it’s apparently illegal for the company and my own HOA to charge a processing fee in Florida?

If they have been charging illegal fees, is there a lawsuit needed? Class action among residents? Or do I go after the HOA processing company and not my apartment complex?

Hi Brad,

It’s worth noting that surcharges are different than convenience fees, and have different rules. It may be that your HOA is charging a convenience fee. We have information about convenience fees here: https://webdevfolio.com/cardfellow_live_9102023/blog/charging-customers-a-credit-card-convenience-fee-at-check-out/#Guidelines

Additionally, Visa and Mastercards’ websites should have additional information. You can also try contacting your state attorney general for clarification.

I have a Marriage and Family private practice in MA and just began charging a convenience fee of $1 per transaction to any client using a credit card to pay their copayment. A client sent me your article, stating that it was illegal to charge the fee in this state. My business is not “business as usual,” and it is not a surcharge (as I see it) but rather a convenience fee. Can I continue to charge this convenience fee? Is it legal? If so, is there some written proof of this that I could pass back to the client? Thanks.

Hi Julie,

“Convenience fee” has a very specific meaning to the card brands, and it doesn’t sound like your application of the fee would count. For example, if you generally swipe credit cards, a convenience fee *might* be permitted in certain instances where you accept a credit card over the phone for a client, as it’s then considered a bona fide convenience to the customer. As you’ve described it, the fee sounds like a surcharge, which is prohibited in Massachusetts.

Even if the fee were permissible, there are rules you’d need to adhere to in order to charge it. If you’d like to go that route, I’d suggesting contacting an attorney familiar with surcharges and convenience fees in Massachusetts to ensure you’re not violating any regulations.

Interesting info here but still have a couple of questions as a consumer using a business that currently charges a 2.75% fee to cover their Square fees:

1) Square charges their 2.75% fee on debit cards also so if I used a debit card, business would be required to waive/ignore this and not pass on the Square fee to me, correct? Since Square appears to say they process debit as credit, it seems, but Visa/MC rules prohibit debit card fees, so how is this handled?

2) Business doesn’t have any warning signs at point-of-entry or point-of-sale which are required by Visa/MC, right? Only notice currently is a small line on a approx 3″x5″ or so card sign at check-in window.

3) Business and myself are located in FL so seems they are illegal here but they could offer 2.75% cash discount as alternative, yes? And if they did, would the disclosure signage still be required?

“Square charges their 2.75% fee on debit cards also so if I used a debit card, business would be required to waive/ignore this and not pass on the Square fee to me, correct? Since Square appears to say they process debit as credit, it seems, but Visa/MC rules prohibit debit card fees, so how is this handled?”

Debit cards are always debit cards, even when “run as credit” and cannot be surcharged.

“Business doesn’t have any warning signs at point-of-entry or point-of-sale which are required by Visa/MC, right?”

Yes.

“Business and myself are located in FL so seems they are illegal here but they could offer 2.75% cash discount as alternative, yes? And if they did, would the disclosure signage still be required?”

Yes, they could offer a cash discount instead. Disclosure signage isn’t required for the cash discount, only for surcharges.

Thanks much for your reply!

After more research, I found info that the FL law blocking surcharges was overturned in a FL court in 2015 and seems (from what i found) that it’s not yet gone to FL Supreme Court for the state to try and win again…so thus FL customers can get surcharged but not sure how well mobile phone device processors like Square and PayPal are informing their customers about the Visa/MC/Discover rules/regs which would apply to them as well even though they aren’t dealing with a typical acquirer like TD Bank, Chase, etc. who likely has better customer support.

Hi I am in NH and bought a large item at a store with Mastercard. There were no signs posted that they would charge a fee for using a credit card. I was told that they charge fees only for large purchases. Can they do that?

Hi Rosa,

There would need to be notification informing you of the fee, and generally they would have to apply it to all purchases. You can discuss it with the store, contact your state attorney general, or report it to Visa/Mastercard.

I got charged $150 “convenience fee” for using a carecredit card at my vet’s office. It’s a standard flat fee. They informed me of it and I signed a paper. However, it’s been brought to my attention that it is illegal for them to do that. Can I still get my money back?

Whether the fee is legal or not depends on a number of factors, including what state the vet is in, and if it was a convenience fee or a surcharge. (Which are technically different things and subject to different rules.) You can try working with the vet if you feel it was charged improperly, or contact your state attorney general’s office.

Hi, we are creating a mobile app that will allow customers to pay for purchases at various stores. Our processor will charge 2.9% + .20. Should this be passed on to the merchants we are representing? Or can we add some fee on top of this? It will be the way we make our revenue. Thanks

Hi Neil,

You can add a fee, but you should be aware that 2.9% + 20 cents is already quite high, and there won’t be much incentive for merchants to use it. Additionally, customers already have a multitude of mobile app choices like Apple Pay, PayPal, Samsung Pay, Chase Pay, etc.

Thanks, Ellen. That is what I am trying to figure out. Shoppers will pay for the items via the card stored in the app. We are about to sign with several stores. So, if we set at 3.9% for example, would our fee count as a convenience fee? Don’t want to violate any Visa rules or state rules.

Convenience fees and surcharges refer to costs passed by merchants to cardholders, so no, unless you’re charging the cardholder and not the business.

Hi, awesome article.

I’d like to ask for advice about deploying a church donation system where Tithing (10%) must not be deducted from the total transaction but preferably added to the total cost of the transaction before “checkout”

For example, I choose to send a Tithe to the church, but in order for the full 10% value to reach the church, I would need to cover the cost of the transaction (say 2.5% as per our local gateway.) So how does the church implement this legally if a surchage/convenience fee is illegal?

For everything other than the tithe, the normal transaction fees work. I’d like to be completely transparent with the people giving.

Thank you!

Hi David,

The church could ask that members consider submitting a higher tithe to cover the costs. You’d need to discuss with your processor exactly how to set it up.

I understand that the amount of a surcharge can not exceed the percentage charged to the store. Our company is on an interchange plus program, how would we determine the percentage to charge since there are different charges for different types of cards?

Hi John,

You would need to work with your processor on that. In general, places that decide to surcharge typically set the surcharge lower than their actual cost to give themselves a cushion.

I live and work in California and I am wondering what the rules for Business to Business transactions are. Can a distributor charge a surcharge to a business for paying with a credit card?

Hi Natasha,

California is still arguing in court about surcharges. For the time being, the courts have ruled that banning surcharges is unconstitutional, so the Attorney General’s office is not able to enforce surcharge bans. The AG has appealed that decision. It’s best to contact the attorney general’s office since the situation is in flux.

When I am averaging the credit card percentages, can I use the average of all the cards we take – Visa, Mastercard, AMEX and Discover? AMEX is more than a full percentage point higher than the average of the others. The business is located in Missouri and sells to businesses in Missouri and Illinois.

Hi Jennifer,

This is something you should work on with your processor. The specific requirements are that you not charge more than the actual cost of processing, so chances are you will not include a much higher card’s costs unless you’re primarily (or only) accepting that card.

We are a retail insurance agency in California who uses a “square” type set up to charge for policy premiums for those clients who prefer to pay via credit card.

We are charged a fee from the credit card company and since we have really no way of padding up the pricing of insurance, we pass this cost off to those customers who want to pay via credit card.

Are we doing it wrong? What should we do?

There isn’t really a good way to handle this in California at the moment. California prohibits surcharges, which is what you’d be doing. The courts and the attorney general are currently fighting about the surcharge law, so until that’s settled, it’s not a good idea to surcharge.

If the cost truly can’t be built into your prices, you may want to consider other options like accepting checks.

This website is a great source of information! Thank you.

My question:

My company operates in Massachusetts, which prohibits surcharging credit cards.

We accept check payments via mail, online checks, and online cards (Visa and MC only). “Online” is our convenient payment channel.

I cannot surcharge because of state law.

Am I correct that I also cannot charge a convenience fee because Visa forbids it because my primary (only) method of accepting cards is card-not-present?

Hi Chad,

Correct. Massachusetts prohibits surcharges and Visa prohibits convenience fees on card not present, so your only real option is to built the cost of processing into the price of your goods/services.

Hi Ellen,

So my company is looking to process “card present” only processing in MA. Am I correct in that I’m not allowed to charge customers? I’ve seen signs listed on many local companies and even my local city hall clerk’s office stating surcharges of 3%. I’m very confused and new to the process. Thanks.

Hi Billy,

Correct, Massachusetts prohibits surcharges. The things you’re seeing at places like city hall are likely convenience fees, which have different rules than surcharges. https://webdevfolio.com/cardfellow_live_9102023/blog/charging-customers-a-credit-card-convenience-fee-at-check-out/#Guidelines

Hi –

My review of the law and subsequent rules and regulations is that a business cannot surcharge in the state where the buyer is located, not the seller.

Am I mistaken?

Hi Robert,

I’m not sure on that. I believe it’s where the transaction is considered to ‘take place’ – that is, where the payment is accepted – but it’d be worth checking with an attorney.

Hi,

Our company is considering accepting credit cards, we are in the state of California. Our normal form of payment is check or wire transfer only. We do business in all 52 states as well as international sales but our warehouse/offices are in California. Since credit cards is not our normal form of payment if we start using it can we charge a convenience fee and if so do we have to exclude the 10 states that prohibit surcharging even though is not our normal form of payment, can we call it a convenience fee?

Hi Yvonne,

Convenience fees and surcharges are different, so convenience fees can typically be charged in any state. However, it’s worth checking with the card brands to ensure you meet the criteria for convenience fees. It’s not enough to simply call a surcharge a convenience fee.

Most of our customers are on Net 30 terms and typically pay via check or ACH at the end of the 30 days. Some call after the 30 days to charge their open balance to a credit card. We are in CT which prohibits surcharges, but are these circumstances different (e.g. payment after 30 days and not at time or shipment)? We would not surcharge if the customer paid with their credit card at the time of shipment.

Hi Jeff,

You may be able to look into convenience fees instead of surcharges, as the rules are different. It could be worth checking with a business attorney to see if that would be permissible for your business within state laws.

As a contractor, we sell to distributors, contractors as well as industrial customers. We were contemplating offering a non-credit card price as well as a credit card price (padded to reflect the fee % we are charged. Our product can cost in the hundreds of thousands of dollars). In essence, we will pay the fee to the credit card company as we currently do, but if a customer (non-consumer) pays by credit, they will pay a higher price. Does this situation fit into the legalities you’ve addressed in this article?

Hi Cathy,

If you’re quoting the higher (credit card) price and offering a cash discount, that’s typically permitted.

I’m a Civil Engineer in CT. I typically invoice clients for professional services. They primary payment channel is by far checks. On my invoice, I have a statement that says, “For your convenience, we now accept most major credit cards.” I use Square to process cards. I rarely have someone use a card and when they do its almost always over the phone. I want to add to my above statement that “a convenience fee will apply”. These professional fees can be many thousands of dollars.

1) Can I apply a convenience fee that is a set amount per $1000, say $50, not an actually % of total sale or

2) would I have to set a predetermined amount for the whole sale – say $150?

Thanks.

Hi Jason,

Convenience fees and surcharges are similar things, but have different rules. Surcharging is not permitted in Connecticut, while convenience fees might be under the right circumstances. I’d suggest checking our post on convenience fees (https://webdevfolio.com/cardfellow_live_9102023/blog/charging-customers-a-credit-card-convenience-fee-at-check-out/) and double checking with a business lawyer.

I just got done eating at a restaurant in North Dakota. On the receipt it said surcharge $2. That was a line item under my $10.99 blt. So the total came to $12.99 and then they taxed it all. I asked them about the surcharge and they said doesn’t matter how much the menu items are, all card transactions get a $2 surcharge, even on my debit card that I used. I know they can’t do this with a debit card but is the set price of $2 allowed and can they tax it in addition?

Surcharges cannot exceed the actual cost of processing, which a $2 surcharge might, depending on the total. (In the case of a $10.99 bill, it likely would.) Surcharges can typically be taxed.

I’m a customer (Texas resident) establishing a monthly payment for services and asked the merchant (Texas business) about paying via credit card. They responded:

“A week before the due date, I will email you an invoice *** there is a fee, I believe it is 3% that the credit card company charges that would be added to the bill.”

Based on everything I’ve read on your website, I do not believe this is allowed – correct?

Surcharges and convenience fees are different things – with an invoice, it’s possible it’s a convenience fee. It would still need to meet the criteria to be considered a convenience fee rather than a surcharge, and there are rules about convenience fees. You can check with the card company/your bank or your state attorney general’s office about specific situations.

Let me see if I’m understanding this. I own a child care center in Texas. Parents are able to pay tuition via cash, check, Paypal, or credit card and bank card on site. I cannot charge parents who choose to pay via credit card or bank card an additional fee for choosing that form of payment. Correct?

Yes, Texas prohibits surcharges for using a card.

I joined a third party site where I sell art on it in New York. The company adds a processing/CC fee of 3% on the entire transaction value to my business and not the customer. Since I am a vendor on the site, does this law still pertain to my business?

Thank you so much.

It’s generally fine to charge businesses for credit card processing, as its a service being provided to you.

These surcharges are tax deductible for businesses. Anyone charging a surcharge is just ripping you off and I would not use their business.

Hi Bob,

“Anyone charging a surcharge just ripping you off…”

OK, Great. You have never run a business in California if you think that a tax deduction makes up for the “loss of cash discount” – or surcharge. If you have run a profitable business in CA, I would gladly pay you for your wisdom and business consulting.

I never mind paying an extra fee even when I know the vendor is not allowed to charge me, I still gladly pay because it is a convenience to ME to use my card.

Sorry Bob, It is a direct expense to the business. Writing it off means nothing if the $10,000 dollars it costs to accept credit cards causes you to raise prices to offset the costs or if the $10,000 dollars puts you in the red (not making any money).

Finally, why should I as a business owner pay for your rewards points on your MC, Visa or the like? So every time you swipe your reward card I am giving you 1 to 2 percent of my sales so you can take a trip somewhere. That would be foolish business. The consumer has been sold another fabrication of how good credit cards are- just go ask your favorite business how they feel about the costs to accept MC/Visa and the like. I am sure you will get a different comment then the one you just stated above.

Connect.studenthousing.com charges $19.95 if I want to pay rent on my daughter’s college apartment.

I can’t believe this is legal.

We sell expensive mobility equipment (wheelchairs) in Texas. Many of our transactions exceed $15,000. We only deal with non-insurance transactions (no Medicare or Medicaid, either) so our customers pay out of pocket. Our credit card charges us about 2% for transactions… that is $300/ wheelchair. With this in mind, are we still required to accept credit cards and not charge a fee? Is our only recourse to raise the price and offer a cash discount? In other words… there is no cap on how much someone can put on a card (anything up to $2000 or something like that) before paying a fee?

Can we simply say, “We don’t take credit cards?” We don’t have it posted anywhere that we DO take cards (we are online only… no brick and mortar locations).

Also, we sell chairs into multiple states. If someone from Virginia wants to buy from us in Texas, can we tell them that we charge a credit card fee? Thanks!

Hi Charlie,

You’re never required to accept credit cards, so yes, you could tell customers that you don’t take credit cards and require payment by check or other methods. However, as an online-only business, you may find that a lot of customers may prefer to pay by card. You’ll need to consider if not taking them will encourage customers to go elsewhere. If your orders are B2B, it may not be as much of an issue since businesses often still cut checks to vendors.

I posted earlier, but wondered about another confusing thing. We don’t advertise allowing credit cards for purchasing our products. It is not on our website, or anywhere else. We are in Texas, which means we can’t charge a fee for a customer using a credit card. So what happens if a customer asks if they CAN us a credit card. We technically can take their card, but based on the law, we have to tell them we can’t, even if they are willing to pay the 2% fee? We don’t want to raise our price just for the 5% of customers who might want to use a credit card, especially when we sell into so many states where charging the customer a CC fee is okay. Our margins are too tight to swallow $300.

It seems like this law could actually be hurting consumers who are okay with paying a fee. Some people don’t mind the fee because using their card is the only way for them to establish a payment plan (it is hard to get a loan for a wheelchair). So am I understanding this correctly… that even if a customer in Texas is willing to pay the 2% fee, we can’t charge it to them?

Thank you again.

“So what happens if a customer asks if they CAN use a credit card. We technically can take their card, but based on the law, we have to tell them we can’t, even if they are willing to pay the 2% fee?”

You don’t have to tell them you can’t take their card, but if you choose to take their card, you cannot charge them a fee for doing so. Your options would be 1) tell them that you don’t accept cards or 2) tell them that you can accept their card, but then you (the business, not the customer) will pay the costs for processing.

While it probably does not violate the law, is it a violation of Visa/MC agreements to only accept credit cards (and not debit cards) so that you can charge the surcharge? I take checks and cash, but no credit/debit cards yet. I’m in South Carolina.

Visa expressly permits accepting only debit cards or only credit cards as part of its “limited acceptance” program, though there are rules. (Like notifying your acquirer, not displaying the typical ‘Visa accepted’ signage, etc.)

However, depending on your average transaction size and some other factors, debit cards can sometimes be less expensive to process than credit cards, so it may be more hassle than it’s worth to refuse debit cards.

Thanks! Is MC silent on the subject? My volume would be about 20k per month and avg $100/transaction.

I’m not sure if Mastercard has a similar program/name, but they may permit it. You’d need to check with your processor.

At $20k with $100 transactions, you may be better off going with debit. Here’s some info: https://webdevfolio.com/cardfellow_live_9102023/blog/pin-debit-vs-signature-debit/

Hello

I received an offer to accept credit card payments whereby the customer will carry the charges. I was unsure if any other merchants offered that same service. Do you know of any that offer that service so I can compare pricing, products, and services?

Hi Diane,

There are a few companies offering such a service. It’s called zero-fee credit card processing. We have an article on it here: https://webdevfolio.com/cardfellow_live_9102023/blog/free-credit-card-processing/

Even though 43 states allow surcharging credit card transactions, I don’t think most cardholders want to be burdened with paying an extra 2-4 % for using their card. It negates the points benefit most consumers get from their card issuers and cardholders will be more likely to have a negative view of businesses who do this. If your processor is pushing a program surcharging program on your business, you should think twice.

Can a company charge a customer service fee on all payments, with a cash discount, to skate the convenience fee laws?

Cash discounts are permitted, but typically need to be given off the regular price. If they’ve raised prices and offer a cash discount, that’s fine.

I hired a moving company out of New Jersey to do an interstate move for me to Georgia. They are telling me that if I use a Visa that they will charge me a 5% fee (which is absurd) on the cost of my move, which is $3,400. That means the fee will be a whopping $170! I thought the max anyone could charge was 4%, is this correct?

The maximum for surcharges is 4%, but it could be different if it’s a convenience fee or something else.

Hi,

Can an online vendor from Georgia charge a customer in New York a 3% processing fee? It’s a wholesaler. They also accept “pay by open account” and COD. Does that make the CC a “bona fide convenience?” NY state does not allow the fees. Thanks in advance.

Is it being called a surcharge or a convenience fee? The bona fide convenience only applies to convenience fees, not surcharges.

Generally, surcharges can be applied in the state where the transaction takes place (if not prohibited by law) which could potentially be considered where the vendor is located. You can try contacting your state attorney general to see if that’s the case for your online transaction.

It’s actually referred to as a “processing fee.” Thank you for your quick response!

The company I work for is a roofing distributor in Georgia. We sell directly to roofing contractors, as well as home owners. This year, they are requiring us to charge all accounts, even COD accounts, a 2.5% courtesy fee when accepting a credit card payment. I’m not very keen on the idea, neither are my customers, but can anybody tell me if this is legal for them to do or not? Since we opened in 2014, we have always accepted credit cards without charging these fees. I asked my credit manager about it, and he says it’s because we are selling “business to business” or something like that. Basically our customers are viewed as business accounts, therefore they can charge the courtesy fee % if they do not pay either with cash, check or online EBT. We have credit card swipers in the office at every computer, so I’m not sure where the inconvenience comes from exactly.

Hi Ray,

Georgia does not prohibit surcharges or convenience, so your company would likely be allowed to add a fee for accepting credit card payments as long as they follow Visa and Mastercard’s rules for either surcharges or convenience fees, depending on what the fee actually is. Convenience fees are typically applied to non face-to-face transactions when there are other methods of payment available (such as cash or in-person payments.) Surcharges are typically added to all charges made by credit card.

Can a moving company charge an 8% processing fee for using a MasterCard in person? No information was given to me over the phone on what payments were accepted and the processing fee was not told to me until the movers arrived for the move.

If it’s a surcharge specifically for accepting a credit card, no, it would be capped at 4%. If it’s some other fee, like a service fee, it may be permitted.

I live in New Jersey. When I used my Health Savings Debit card at my pediatrician I was charged a convenience fee. Is this legal? Furthermore my receipt did not indicate that a service fee was charged. Is this correct?

Debit cards can’t be surcharged. Your best bet would be to speak with the doctor’s office first; you can also optionally report a surcharge to the card brands on their websites.

What if a customer requests a refund on their card from a previous month because they want to run the payment on anther type of credit card? Could you ask them to pay the processing fees incurred by the initial transaction? If so would this be a “convenience charge?” This is in Tennessee. Thank you.

If you process a refund for a customer, your processor should be returning some of the fees for processing the original transaction. Unfortunately, many processors don’t. This would be worth a read: https://webdevfolio.com/cardfellow_live_9102023/blog/credit-card-refund-fees/

Hi my name is Susan. I know of a business in my home town that charges $2.00 on an inspection sticker that costs $18.00, so they’re making money. I ask if they were with a company that does cash discount; they said no. I said to them you can only charge 4% if you’re with a company they said we have been doing it for over 2 years and no one ever said anything about it. They basically told me the were not going to change their policy. So they continue to do it on their own and charge customers $2.00 on $18.00. Were can I find a law that tells them they can’t do this to customers? I’ve read that they have to be with a company and they can’t charge over 4%. Tell me where this law is.

Thank you, Susan.

Hi Susan,

Surcharge policies are Visa/Mastercard regulations, not laws, unless you’re in a state where surcharges are not permitted by law. Since this sort of thing is very state-specific, your best bet would be to check directly with your state’s Attorney General’s office. They typically have people that can respond to consumer questions and offer assistance.

I hope this helps!

How can companies do this when they can recover the money back with income tax returns? Seems like they are double dipping?

Hi James,

Surcharges will count as revenue for a business. So while they can deduct processing fees, the additional revenue will be included.

The local bar started charging 4% on all credit, debit transactions. I specifically asked if that included debit cards and they said yes. How and where do you report this business anamously since i like going there and my tab is always less than $10 and i pay cash unless i order food.

Hi Greg,

It’s usually best to try to work out any fee disputes with the business, but you can report them to the card brand. Visa has a form on their website for reporting here: https://usa.visa.com/Forms/visa-rules.html

Mastercard’s is here: https://www.mastercard.us/en-us/consumers/get-support/report-problem-shopping.html

Are purchase cards, p cards, petty cash cards considered debit cards? Therefore not subject to the surcharge. We do business with government agencies and some companies that use what they call p cards. I am in Georgia and we started charging surcharges in Oct of ’18.

Hi Erin,

Purchasing cards are not debit cards. They would not fall under the surcharge rules for debit. I hope this helps!

I live in Jacksonville, FL and have a debit visa. I went to the local convenient store and bought a Tobacco product which with tax included was $1.07. The consumer said I would have to pay 50 cents if I spent under $5 Is this legal?

Businesses cannot require minimums for debit cards. You can report it to your state’s attorney general.

Today I was charged an extra 3% on a $4,161.00 bill by a RI mechanic. They call it a 3% card fee. I used my BOA debit card Visa. The mechanic said that their machine runs them only as credit cards. So I ended up paying $4,286.58 in total because I did not pay them in cash. I was not offered a discount off of the $4,161.73 bill, I was just charged 3% extra because I paid with my Visa.

I have been adamant that the consumers were not considered in these purchasing decisions.

1: Why should I pay a surcharge or processing fee when I am already paying interest (in some cases high) for using credit?

2: These fees were meant for the retailer/vendor to make them pay for the advantage of having their customers use credit. Using credit allows consumers far more money to purchase items that many cannot immediately afford.

3: By making additional capital available to consumers, they are more likely to purchase large items that allow for payment over time.

4: These rulings appear to result from strong retailer business lobby groups rather than a genuine concern for the consumers affected by these additional fees. I have significantly curtailed any personal credit usage due to these fees, and they fundamentally violate my respect for “character” when operating a business.

5: Were consumers fairly represented when these fees were legalized in the cases you mentioned? How is this a free speech issue for businesses? This credit fee usage policy is a business practice hitting consumers twice in their pocketbooks.

6: I do not believe these fees were initially designed to be passed on to the consumer. Credit companies likely created them to achieve higher profits by using vendor fees to obtain additional earnings by billing the vendors for credit usage, not as costs in addition to the consumer’s already high-interest rates.

7: There appears to be a cap on some fees charged based on the actual costs associated with the credit transaction. Some consumers are already charged credit interest rates that will make the amounts owed almost impossible to pay off. Why isn’t a cap placed on what credit card companies can take from their customers? Are the high-interest rates reasonable considering the cost of doing credit business? I do expect a “reasonable” profit margin for the card company. Who oversees the profits these companies (vendors and credit card issuers) are making at the cost of those who may be least able to afford this additional consumer purchasing power?