Credit card processing can be expensive, and hidden fees may be part of the problem. Have you ever looked at your credit card processing statement and noticed “non-qualified” transactions with a higher rate than what you thought you’d be paying? That’s one of the 3 most common hidden fees that might mean you’re paying more than you need to for credit card processing.

Use this article to determine if you’re overpaying and get tips on finding a credit card processing company that won’t gouge you with these hidden fees.

- 1.“Non-qualified” Transaction Downgrades

- 2. Lost Interchange Credits on Refunds

- 3. Padded Assessments

- Okay, so how do I avoid these hidden fees?

1. “Non-qualified” Transaction Downgrades

If you look at your credit card processing statement, do you see “non-qualified,” “non-qual,”or “nqual” listed anywhere? That’s your first red flag that you’re falling victim to one of the most expensive hidden fees of credit card processing.

Non-qualified transactions are found on what’s called “tiered pricing” and mean that you’re paying more than you have to. With a tiered pricing model, your processor quotes you a rate, usually very low. This rate applies to what your processor determines are “qualified” transactions. Anything that it decides isn’t “qualified” gets downgraded to a “non-qualified” transaction and you’re charged a higher rate. Sometimes much higher.

Another big problem is that there’s almost no explanation of what makes a transaction “non-qualified.”

Even worse, your processor can change it any time it wants. There’s nothing you can do about it, and you’re completely at your processor’s mercy.

However, Visa muddied the waters of non-qualified transactions by changing some of their “downgrade” categories to the name non-qualified. This means that your statement could have a mix of card brand “non-qualified” and processor-invented “non-qualified” transactions.

Non-qualified transactions were previously not a classification imposed by the card brands (Visa, Mastercard) and were not a part of processing that you just have to deal with. Now, they may or may not be, and understanding when it applies can take a little extra time and knowledge.

The best thing you can do to minimize the expense, confusion, and annoyance of “non-qualified” fees is to switch from tiered pricing to interchange plus. This will minimize the chance of any non-qualified transactions that aren’t a direct result of Visa’s interchange qualifications.

Take Action

What to do about it: Switch processors.

It’s extremely unlikely that you’ll be able to get a competitive processing solution on a tiered pricing model. Even if your tiered-pricing processor agrees to lower your costs or says it’ll match a better quote, chances are you’re going to see your costs creep right back up. If you’ve caught your processor overcharging you using non-qualified transaction pricing, don’t reward it and think that things will change. Find a processor that will charge you fairly and transparently, such as processors that use interchange plus pricing.

You can use CardFellow’s free processor comparison tool to get quotes from processors that will never charge you non-qualified rates.

2. Lost Interchange Credits on Refunds

As a business owner, you’ve probably processed a refund for a customer at some point. Maybe the sweater was the wrong color, or the shoes didn’t fit right. You refund the customer’s purchase and take back your merchandise. But what happens behind the scenes, with the costs for that transaction? If you don’t have a processor that passes interchange credits, you’re paying more than you should.

When your customer paid with their card, you were charged to process the transaction. Included in that cost is the interchange fee, or the amount of money that goes to the bank who issued the credit card to your customer. When you refund a transaction, the bank gives a portion of that interchange fee back to your processor, who is supposed to give it back to you. But, sometimes the processor just keeps it. That means lost money for you and more profit for your processor.

If you’re on bundled pricing, you’re never going to see your interchange returned. The lack of transparency makes it easy for processors to keep your interchange credits. It’s easier to get the credits on an interchange plus pricing model, but it’s still not guaranteed.

Take Action

What to do about it:

Option 1 – let CardFellow handle it for you. We require that processors return interchange fees on refunds to you.

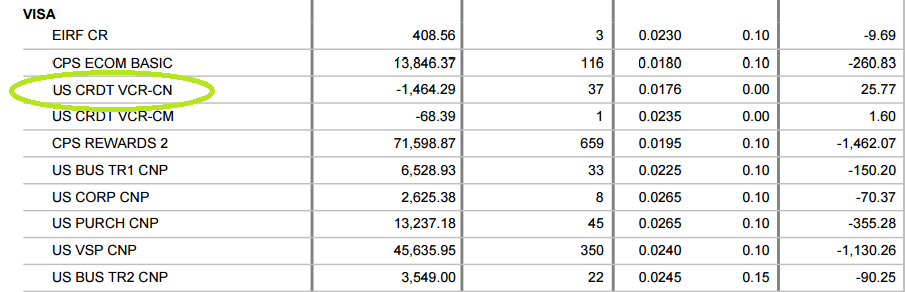

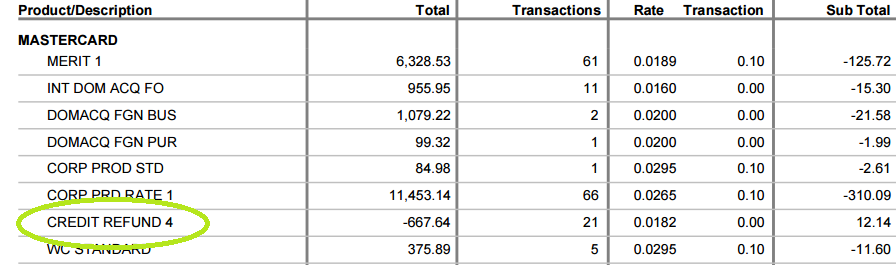

Option 2 – Ask the processor if they pass on interchange credits for refunds and monitor it yourself. However, this option only works if you have a detailed statement and know what to look for to ensure you actually get the refund. Interchange credits can be listed in a variety of ways. A few examples are shown below:

If you don’t have time to learn everything about interchange credits and how they’re labeled and just want to know that you’re getting them, we recommend option 1 – let CardFellow take care of it for you.

All you need to do is choose a processor through the CardFellow marketplace. We require (via a legal, binding contract) that all processors placing certified quotes through CardFellow issue interchange credits to you when you give a refund to a customer, and then we monitor your statements to make sure it happens. Without CardFellow’s oversight, processors don’t have to pass along interchange credits, so there’s no guarantee you’ll get them.

3. Padded Assessments

Assessments are one of the two non-negotiable costs of processing. They’re the charges that are set by and paid to the credit card brands (Visa and MasterCard) and disclosed in our article on processing fees. So how can there be a “hidden” fee if the assessment charges can be found easily online and they’re non-negotiable? Easy: the fees can’t be negotiated lower than what Visa and MasterCard set… but there’s nothing to stop your processor from charging more, or “padding” the legitimate assessment fee.

In Practice

Payment processor Mercury Payment Systems has been sued twice for that exact type of deceptive pricing, and in reviewing statements here at CardFellow, we saw the padding firsthand. Instead of charging businesses the actual assessment cost, Mercury chose to add a few cents to the assessment fees every time a transaction took place. The result is higher-than-necessary processing costs that are cleverly disguised as non-negotiable legitimate fees. And they’re not the only ones that do it.

The thing that makes padded assessments more dangerous is the fact that it’s possible on an interchange plus pricing model. It’s important to know that while it’s often a competitive and transparent option, you can still get gouged on interchange plus because of things like padded assessments.

What to do about it: Work only with processors that offer true pass-through pricing, meaning processors that charge you the actual cost of interchange and assessments.

Okay, so how do I avoid these hidden fees?

Choose a credit card processing company that doesn’t charge using a tiered pricing structure but instead offers true pass-through pricing, and commits to issuing interchange credits. If that sentence seems easier said than done and you’re dreading the thought of hours of research and phone calls, you can skip the frustration and have us do it for you. Every processor that places certified quotes in the CardFellow marketplace is legally bound to use true pass-through pricing and to issue interchange credits.

Ready to save? Sign up for free.