No matter what items you sell or services you provide, a profit and loss statement (P&L) is essential and required by the Internal Revenue Service.

You’re excited about the creation of your business. Your hard work is coming to fruition and your business is going live. Even if your entrepreneurial spirit isn’t particularly geared toward financial accounting, it’s a crucial part of your business’ success or failure.

Fortunately, there are P&L templates available, and accountants are very accustomed to helping businesses set one up. Let’s take a look at what a profit and loss statement is and how to use it to make effective business decisions.

- What is a P&L?

- The Basic Formula

- What is a P&L used for?

- Related Terms

- Getting Started: Creating a Profit and Loss Statement

- Basic Elements of a P&L

- Additional Components

- P&L Template

- P&L Projection Model

- Protect Yourself: Review Your P&L Regularly

- Non-Profit Organizations

- Common P&L Mistakes

What is a P&L?

A profit and loss statement (commonly called a P&L) is a financial document that measures your expenses and sales during a certain time period. It is a financial snapshot of your company during that month, quarter or year, giving you insight on what your business is doing right and what needs changing.

Other Names

Accountants sometimes use other terms for the same document. If your accountant uses any of the following terms, she is referring to a P&L:

- Income statement

- Statement of income

- Financial results statement

- Earnings statement

- Operations statement

The Basic Formula

A P&L consists of one basic formula: Sales – expenditures = profits. Those profits are your net income, or funds left after accounting for taxes, employee costs, and operational overhead.

What is a P&L used for?

The P&L is the document used by the IRS to assess taxes on your company’s profits. It makes up one-third of the typical business financial statements, the others consisting of a balance sheet and cash flow statement.

The balance sheet deals with current and fixed assets, short-term liabilities and long-term debt.

The cash flow statement is concerned with money coming in – “inflows” – and money going out – “outflows.”

Both the P&L and cash flow statement allow you to look at your finances over a period of time, while the balance sheet captures a particular moment in time. The P&L allows you to determine your net profits and make sales and expense projections. In simplest terms, it lets you know whether or not your business is making money during the specified period.

Identifying Business Cycles

Your P&L also tells the tale of how profitable your business is or is not, and the timeframe of your major profits and losses.

If you’re in a seasonal business, you know that certain times of the year are lucrative and others slow. Those operating businesses not especially subject to seasonal ebbs and flows can determine a company’s most and least profitable quarters via examining the P&L, and figuring out the circumstances. Regular review of your P&L tells you what areas of your business generate the most profit and which generate the most costs. It also allows you to look for trends that may not be apparent until you see them in black and white.

Lastly, if you want to borrow funds, it helps a lender determine your company’s creditworthiness. When seeking business loans, banks may require a P&L statement as part of the application process.

Related Terms

For accounting purposes, “earnings, profits and income” are synonymous. However, the P&L indicates profit, or its lack, not cash flow. That’s the total amount of money coming in and out of your business, and, as noted, is a separate statement.

Here are some other accounting terms dealing with P&Ls and their meanings:

- Cost of Services (COS) – used primarily in businesses selling services rather than materials

- Cost of Goods Sold (COGS) – anything related to the overall cost of your product.

- Selling, General, and Administrative Costs (SGA) – Non-production costs, including legal and accounting expenses and advertising. It also includes indirect costs, such as pitching a client over a business lunch.

Related article: Calculating Margin

Getting Started: Creating a Profit and Loss Statement

It’s wise to consult an accountant before getting started with a P&L. He or she can recommend the best accounting software for your company, as well as the best way to break down your costs.

Even if you are a sole proprietor or your business is quite small, you’ll need P&Ls even if you think you know exactly how many dollars come in and how many are spent. A quarterly rather than monthly P&L may suffice, but it is still necessary documentation.

Single Step vs. Multi-Step

There are two basic methods of P&L construction – single step or multi-step. For most small businesses, the single step suffices. You total your revenues, subtract your expenses, and the result is your bottom line. Once you become more comfortable with financial reports and your business grows, you may consider multi-step P&Ls. As the name indicates, they involve additional ways to get to your bottom line, including subtracting operating expenses from the gross profit to reveal income from operations. Your accountant can tell you whether your business would benefit from this more complex type of P&L. Otherwise, it’s fine to go with the single step format.

The P&L has to make sense not only to your accountant, but to you. When you are starting out, you may want a simpler format. As you become more familiar with it, you can add more specificity to your P&L. The overall information is always there, but it’s a matter of how much detail you want.

Accounting Software

QuickBooks is probably the most common accounting software used by small businesses, but it isn’t your only choice. There are ample paid and free software choices, including up-and-coming options like FreshBooks and Xero. You can also design your own P&L using Excel. If you aren’t comfortable using your accountant’s recommended software, ask about suitable alternatives. The most important factors will vary depending on your needs and level of technical skill, but may include ease of use, quality of customer support, and other features specific to your business.

Related article: QuickBooks Integration with Credit Card Processing Data

Basic Elements of a P&L

Four categories make up basic income elements: revenue, expenses, losses, gains.

Revenue – operating revenue relates to the amount of money your business takes in, primarily through sales of goods or services. Larger businesses may have other sources of revenue earned outside business activity, such as investment income.

Expenses – operating expenses are those necessary for conducting your business, such as employee salaries and benefits, rent, utility payments, and administrative costs. Operating expenses also includes any advertising, research and development, and costs for credit card processing.

Depreciation and amortization are another form of expenses, and refer to your capital investments. Rather than write off the entire investment in the year of purchase, certain capital investments – technology, equipment and furniture – are depreciated over their useful life. The IRS determines the useful life of a particular property. For example, trucks and computers are depreciated over five years, while office furniture has a seven year depreciation schedule. If you own a commercial building, the majority of such structures are depreciated over a 39-year period. Amortization is akin to depreciation of your intangible assets. Those include trademarks, patents, software, brand recognition, intellectual property and “goodwill.” Amortization is based on the asset’s useful life, which relates to contracts and legal provisions, as well as economic realities. If any of this applies to your business, it’s an area where you should seek advice from an accountant.

Losses – if your expenses exceed your revenues, you’ll end up with a net loss for the period in question. It’s not unusual for a company to experience a net loss over a month or quarter, but it is imperative that you understand why these losses occurred and try to mitigate them.

Gains – these are one-time events benefitting the bottom line, or funds coming in from a non-primary source.

The upper portion of the typical P&L shows your company’s gross profit. That’s all of your business’ income. It consists of all of your sales revenue, minus the cost of selling your goods.

Once you determine your gross profit, start subtracting your overhead expenses. The amount remaining is your net profit or loss, or the actual amount of money after all expenses are deducted. It is, quite literally, the bottom line of your P&L.

The exact way your business breaks down revenue and costs depends on the nature of the business and bookkeeping preferences. If you have a small business whose revenue comes in from various streams, such as sales, consulting and project management, you would probably want to break down these revenue categories separately on your P&L. That way, it’s easy to see the variation between these income sources, and where you might want to concentrate your efforts. Although they are broken down, the components are added into “total revenue.” The same breakdown makes sense for different costs. A detailed breakdown is a simple way to determine your highest costs, and allows you to investigate ways of lowering them.

That’s the basic overview of a profit and loss statement. However, additional components may come into play, which I’ll go over in the next section. Note that not all of these pieces may be relevant to your particular business.

Additional Components

In addition to the basic P&L components detailed above, there are other factors that may be relevant, including interest expense and income, income taxes, and earnings per share.

Interest Expense and Income

Your company’s interest expenses and income, if applicable, are part of your P&L. The former is the amount of interest you pay on loans, while the latter is the money coming in from certificates of deposit, money market accounts, and similar interest-bearing sources. Your P&L can show these interest expense and income separately or combine them. Add or subtract the overall interest amounts from your operating profits.

Income and Other Taxes

Income taxes are reported as an expense, and appear on the line prior to the net income calculation. You would include federal, state and local taxes, but not property taxes. The latter is deductible, and appears as an operating expense as part of overhead. To lessen confusion, property taxes may be listed on the P&L as “taxes other than income taxes.” That category may also include applicable franchise taxes and any taxes specific to an industry.

Earnings Per Share

If your business has shareholders, there’s an additional calculation – earnings per share (EPS). As the U.S. Securities and Exchange Commission explains, “This calculation tells you how much money shareholders would receive for each share of stock they own if the company distributed all of its net income for the period.” If you generally reinvest earnings in your business, you’re not alone. While companies virtually never distribute all of their earnings to shareholders, it is important information to have. Calculate EPS by taking the total net income and dividing it by the company’s number of shares outstanding.

P&L Template

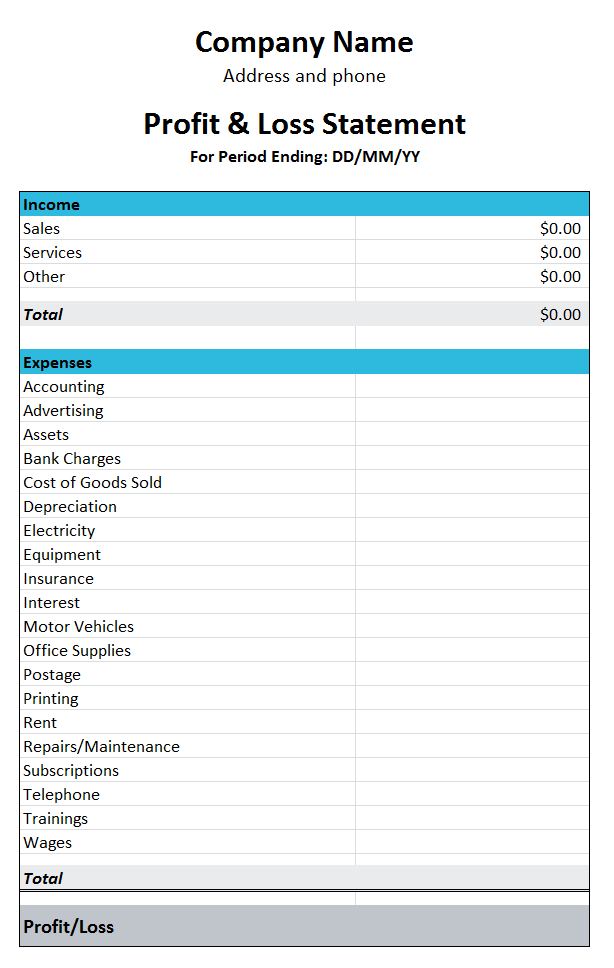

Now that you know what the P&L includes, you can start setting up a template and putting in numbers. Your P&L starts with the header, containing the name of your business and the reporting period. That’s followed by:

- Revenue – the reason sales are often referred to as “the top line”

- Expenses

- Extraordinary Expenses – one time, unusual expenses. Only necessary for the reporting period in which the uncommon expense occurred.

- Net gain or loss

These primary categories have the appropriate revenues or expenses listed under them, as in this example of a single step P&L:

Your P&L may look different, as more or less categories may apply.

P&L Projection Model

You can use the information in your P&L to construct a twelve-month “Profit and Loss Projection Model.” This forecast helps you project your company’s profits and losses over a year, and allows you make budgeting and resource allocation plans. It’s essential if you plan to bring on investors. Project your earnings based on current information, whether positive or negative. If you are bringing in new clients or accounts and expanding, that is a positive projection. If you have recently lost a large customer or if regulatory issues may adversely affect your business, that’s a negative projection. The advantage of the P&L projection model lies in preparing your business over the following year for these likely benefits or deficits.

Protect Yourself: Review Your P&L Regularly

Even if you’d rather have a tooth drilled than do bookkeeping, understanding your financials and especially your P&L is essential to protecting your business. It’s not just a question of knowing the current state of your business. It’s also ensuring that a bookkeeper or other person with access to your finances is not embezzling funds. You’ve probably heard lots of stories regarding company embezzlement and wonder why it went undetected for so long. It’s generally because a supposedly trustworthy person was keeping the books and no one checked on him or her.

Protect yourself and your livelihood not only by understanding and regularly reviewing your P&L but by having a checks and balances system in your bookkeeping department. If money flows out of your business for any reason, at least two people should have oversight. Periodic audits of your books are another way to make sure there is no financial skullduggery going on.

Nonprofit Organizations

If you are running a nonprofit organization rather than a for-profit enterprise, you do not file a P&L. However, such charitable organizations must file a similar statement, known as the income and expense statement or statement of activity. It resembles the P&L in that it tracks income minus expenses, resulting in either gains or losses.

Common P&L Mistakes

Certified public accountant Patricia Vroman Stuart, licensed in New Jersey and Florida, advises a small business person just starting out to consult with an accountant. “It’s not necessary to use the accountant on an ongoing basis, but it’s important to set up the account correctly and know what type of business to have – a sole proprietorship, corporation or limited liability corporation,” Vroman Stuart says. “It’s worth the investment to get some professional advice and it is deductible as an expense.”

She finds mistakes most often made on P&Ls on the cash and/or accrual basis. “I have seen clients set up in QuickBooks as a cash basis – when they are accrual – but they have accounts receivable (AR) and payable (AP), and when the report is run, it does not calculate the accruals for AR and AP.”

Misclassified expenses are also common mistakes. Examples include loan payments posted to an expense category when only the interest is expensed, while the balance of loan payment should go to the loan balance on the balance sheet. She recently met with a client who bought new equipment but never posted the equipment to fixed assets and just set up the payments in an expense category. “They should have posted the equipment as assets, and then posted the loan as a liability. Then when it was paid, posted part to interest expense and part to the loan,” she explains.

Other frequent mistakes include posting a check as an expense when it is not a true expense but a balance sheet item, which does not impact the bottom line of the profit and loss. Many mistakes are made when setting up a chart of accounts, again, due to incorrect classification, according to Vroman Stuart.

You can avoid many of these issues by consulting with an accountant at the start, and checking in as you have questions.

One you get the hang of collecting and entering data for your P&L, you’ll see it for the valuable tool it is, rather than an IRS necessity. Regular review of your P&L aids you in making decisions for your business going forward. With a small business, you can’t just rely on intuition nor have a feel for the way sales are going. You need the numbers provided by your P&L to actually show you the money.