Interchange optimization goes beyond the basics of credit card processing. It’s about making sure that your interchange charges (the fees going to the banks that issue credit cards) are optimal for your business and that you’re avoiding downgrades.

For most businesses, the problem with ensuring optimal interchange is that it’s confusing, and your processor has no incentive to assist you. The time needed to learn the ins and outs of interchange in order to ensure you’re properly optimized is significant, and since the savings only benefit you, not your processor, you’re usually on your own. However, if you’re a CardFellow client, we include interchange optimization as part of your statement audits.

Not a CardFellow client yet? Fill out a business profile to get started.

- Who Needs Interchange Optimization?

- Interchange and Downgrades

- Pricing Models and Interchange Optimization

- How much can I save?

Who Needs Interchange Optimization?

Every business benefits from optimal interchange, but some industries are more likely to see downgrades or have opportunities to lower target interchange. Business to business (B2B) companies, businesses that sell to the government, and any business that processes “card-not-present” transactions (such as ecommerce websites and those that key in card information) are particularly likely to have downgrades that can be corrected to lower costs.

Interchange and Downgrades

If you’re not familiar with the basics of interchange, you may want to check out our post on credit card processing fees first.

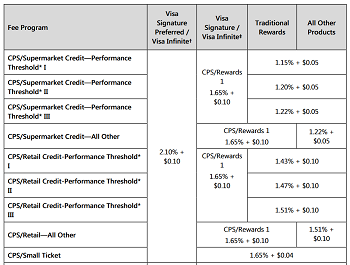

Interchange is the component of credit card processing fees that goes to the banks that issue credit cards to consumers. Every time a transaction is processed, it’s routed to an interchange “category” that has a rate and fee assigned. There are hundreds of interchange categories. Below is a snippet of Visa’s interchange table.

Every transaction has what we call a “target” interchange category – the category that a transaction will be routed to unless something was done wrong. If everything goes correctly, the transaction will “qualify” for the target category and be charged the rate and fee associated with that category. However, not every transaction qualifies for its target category. When that happens, the transaction “downgrades” to a more expensive category, costing your business more money.

In some cases, you can take specific steps to avoid downgrades. For example, businesses processing card-not-present transactions without using Address Verification Service (AVS) can often fix downgrades by utilizing AVS. These small shifts can help ensure you’re receiving the best possible interchange category for your transaction.

Interchange optimization is the process of limiting downgrades to ensure that as many transactions are hitting the “target” category as possible.

But optimization goes beyond simply avoiding downgrades. It’s also about achieving better “target” interchange. This primarily applies to situations like B2B transactions, where you’re required to provide additional data to “qualify” for lower cost interchange categories.

Related article: Downgrades at Interchange.

There is No “Perfect”

It’s important to note that it’s not usually possible to completely eliminate downgrades; that’s just the nature of processing. Maybe you miss the window for settling a transaction, resulting in a more expensive interchange routing. However, there’s a big difference between a few transactions downgrading and most of your transactions downgrading.

If you see a lot of lines on your processing statement with the words “EIRF,” “Standard,” or “STD” you may have an excessive amount of downgrades costing you money.

(Note: EIRF as a Visa category has been changed, but could still appear on statements.)

Pricing Models and Interchange Optimization

Interchange optimization can save you money, but only if 1) you’re on a pricing model that allows the savings to be passed to you instead of your processor and 2) you’re able to see transaction-level interchange detail on your statement.

You’ll see the savings from optimized interchange if you’re on an interchange pass-through pricing model. You won’t see savings on a bundled or flat rate pricing model.

Interchange Pass-Through Pricing

Pass-through pricing, also sometimes called interchange plus, cost plus, or interchange pass-through, is the most transparent pricing model and the one that offers the most benefit from interchange optimization. It’s what we require for processors that place certified quotes here at CardFellow.

On a true pass-through model, the processor charges you the actual cost of interchange and applies a separate markup. This means that when your interchange costs are lower, you pay less. Interchange optimization helps correct downgrades that raise your interchange costs, a crucial component when you’re on interchange plus pricing.

Bundled Pricing

Bundled or tiered pricing is a model in which the processor makes up its categories and routes your transactions to those categories. Typically, the processor will create three categories: “qualified,” “mid-qualified,” and “non-qualified.” The processor will assign a rate to each tier, and then route your transactions to those tiers at its discretion. Though three categories are common, processors can create more or fewer, if they want.

On some bundled pricing statements, you may see interchange detail while on others you won’t. The nature of bundled pricing makes it very difficult to optimize interchange. However, in this case optimizing interchange is putting the cart before the horse. It’s important to first secure a competitive processing solution with transparent markups, which is not possible with bundled pricing.

The routing of your transactions doesn’t matter much if your processor controls which rates your transactions “qualify” for.

Flat Rate Pricing

With flat rate pricing, not only will you not see the savings from interchange optimization, you probably won’t even know if your transactions are downgrading. Flat rate processors do not provide interchange detail.

Flat rate pricing works by applying one rate to all of your transactions. The one rate covers the interchange costs and doesn’t fluctuate. While some businesses prefer the simplicity, it can also be more expensive since you don’t see the savings on lower cost transactions.

Even if you could see which of your transactions are downgrading on a flat rate model, correcting them would result in lower base costs that are not passed to you, but instead kept by your processor as greater profit.

Related Article: Credit Card Processing Pricing Models.

How Much Can I Save?

Downgrade categories like STD can have rates as high as 2.95% for interchange alone, before the card company or processor adds any of their fees. Depending on the type of card used and how many downgrades you have, the savings can be significant. B2B businesses can save up to 1.15% on commercial card transactions when properly using level 2 and level 3 data.

Credit card processing isn’t cheap, but don’t make it more expensive by paying for downgrades. Interchange optimization can help ensure you’re paying as little as possible for credit card transactions. If you need help, sign up for free quotes to see how CardFellow can help.