In April 2008, Visa implemented an international service assessment (ISA) fee of 0.80% (eighty basis points). In April of 2019 Visa increased the base ISA fee to 1.00%. The fee applies along with other Visa fees for international transactions.

The International Service Assessment (ISA) fee only applies in situations where a US-based business accepts a Visa card issued by a non-US Bank. If you take card payments from foreign visitors in person or accept foreign transactions online, you may see the ISA fee as part of your processing costs.

- Visa’s Assessment Fees

- The International Service Assessment

- Locating the ISA Fee on Statements

- Reducing Visa Acceptance Costs

Visa’s Assessment Fees

The ISA is one of many assessment fees that Visa charges. While assessments are typically small, the international service assessment (and other international fees) are among the highest due to the increased risks of foreign transactions. Additionally, multiple assessments can apply to a single transaction.

Visa sets assessment rates, and they’re the same for everyone. Processors don’t negotiate assessments individually for each business. CardFellow maintains a list of the assessments and current rates. You can view that list here: Visa Assessment Fees.

The International Service Assessment

One of Visa’s assessment fees is the International Service Assessment, or ISA. Like the International Acquirer Fee, the ISA fee applies to all transaction involving a U.S.-based business and a foreign card issuer.

The ISA is separate from interchange, and from Visa’s standard assessment fee, which is currently 0.13%. These fees can apply together.

For example, an ISA fee of 1.00% will be added to a transaction where a customer pays using her Visa-branded credit card that is issued by a bank based outside of the United States.

Since the ISA is separate from interchange and other assessments, Visa’s total assessment on this type of transaction is the sum of the ISA fee (1.00%), the standard credit assessment (0.14%), and the International Acquirer Fee (0.45%). The transaction would incur 1.59% in assessment fees. That amount is in addition to the costs of interchange and the processor’s markup.

Locating the ISA Fee on Statements

The ISA fee may or may not be present on your monthly credit card processing statements. Businesses on a flat rate pricing model will not see assessments broken down individually. (Although you’re still paying them! It’s just lumped in to your flat rate.)

Businesses on tiered or interchange plus pricing will usually see assessments as individual line items. Your processor may group them by card brand or simply list them all without breaking them down further.

Fortunately, many processors list the international assessments by easily recognizable names. In the statement snippet below, the processor abbreviated the fee, but it’s still easy to tell it’s the international service fee.

![]()

The more complicated part of this statement is that the processor doesn’t list the rate it charged. However, it still listed the volume to which the fee applied, and the total charge. Using that information, it’s possible to calculate the rate. If we divide the total fee by the volume, we’ll get the rate. 10.09 / 1260.55 = 0.0100. We can multiply that by 100 to get the percentage, which we see comes out to 0.80%. Therefore, this processor charges the ISA fee at cost.

Note: The examples above and below show the ISA fee as 0.80%. The ISA was increased to 1.00% in April of 2019.

Note to CardFellow clients: We check your statements for you as part of our audit service. You won’t need to do the math yourself. Additionally, we require processors to pass interchange and assessment fees to you at cost.

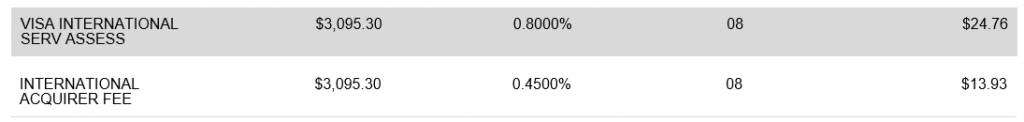

ISA and IAF Together

While the example statement above only listed the ISA fee, in many cases you’ll be charged both the ISA and IAF. In the example below, the processor charged both fees on the same transactions. Again, they’re listed clearly by name. In this statement, the processor also included the rate it charged the business. If you wanted to do the math anyway, you could simply multiply the total transaction volume (3095.30) by the rate (0.008 as the decimal version of 0.8000%.) You then get $24.7624, which rounds to $24.76 – exactly what the processor charged.

For this statement example, I condensed the fees so they were right next to each other. However, your processor may not necessarily list the assessments together. Be sure to check the entire fees section if you’re looking for particular fees.

Remember, you may not see the ISA fee on statements even if other assessments are listed. You’ll only see the fee in months where you’ve accepted a foreign-issued card.

Reducing Visa Acceptance Costs

Let’s be honest – Most businesses want to pay as little as possible for credit card processing. If that’s your goal, the best place to start isn’t with assessments, which aren’t negotiable anyway. Instead, you’ll want to tackle processor markup. If you’re not getting a competitive markup, you’re paying more than you have to.

The easiest way to compare markups is to use a price comparison tool that shows you the breakdown of interchange, assessments, and markups. That way, you can compare apples to apples and ensure you’re looking at the full picture. CardFellow offers a free comparison tool that shows you the costs for your specific business. CardFellow’s processing experts are also on hand to answer questions or walk you through comparing different processors.

It’s free to use and no obligation. Try it now!

I am so incredibly underimpressed by this. Now, I have a new fee that has cropped up out of the blue. It’s bad enough my bank balance only earned 10 cents for the month. Now, Visa’s 9 cents, followed by 85 cents, took away that little bit of earnings. How much money do you need anyway? Oh, that’s right. All of it!

You might get the idea I’m ticked. You’d be right.

So tired of crumbs.