On the surface, “card-present” and “card-not-present” seem like self-explanatory terms. Either the card was present at the time of a transaction or it was not present.

However, the rise of alternative payment channels has muddied the waters a bit, leaving some businesses confused as to why their transactions are card-not-present (CNP) when they expected card-present (CP.)

Types of Transactions

Firstly, let’s define “card-present” and “card-not-present.” More than just the physical presence of the credit card, a transaction is considered “card-present” only if electronic data is captured at the time of the sale. You can capture data by swiping a magnetic strip card, dipping an EMV chip card, or tapping an NFC / contactless digital wallet with a stored card, like a smartphone using Apple Pay.

All other payment methods constitute “card-not-present” transactions even if the customer physically brings the card at the time of the transaction.

Card-present transaction methods include:

- Traditional countertop credit card machines

- POS Systems with card readers

- Contactless-enabled terminals

- Card readers connected to smartphones or tablets

Card-not-present transaction methods include:

- Online shopping carts

- “Buy” buttons on websites

- Recurring or subscription billing

- Electronic invoicing

- Orders taken over the phone and manually entered

- Payment apps on smartphones or tablets that don’t use a card reader

In each of the card-not-present cases above, even if a card is with the customer, the electronic data (the data on the magnetic strip or chip) wasn’t provided with the transaction, which makes it “card-not-present.”

Why does it matter?

There are a few reasons that you should care about whether transactions are considered card-present or card-not-present. The primary two reasons are that the input method affects your costs for processing and can affect your chargeback liability.

Costs for Processing

*** If you’re unfamiliar with processing, check out our credit card processing guide. ***

As a quick refresher, the cost for any credit card transaction consists of three components: interchange, assessments, and markup. Interchange accounts for the bulk of a transaction’s cost to process, but there are hundreds of interchange categories. Furthermore, which category a transaction falls under varies depending on several factors. One of those factors is how you enter the card.

Card Present Interchange Example

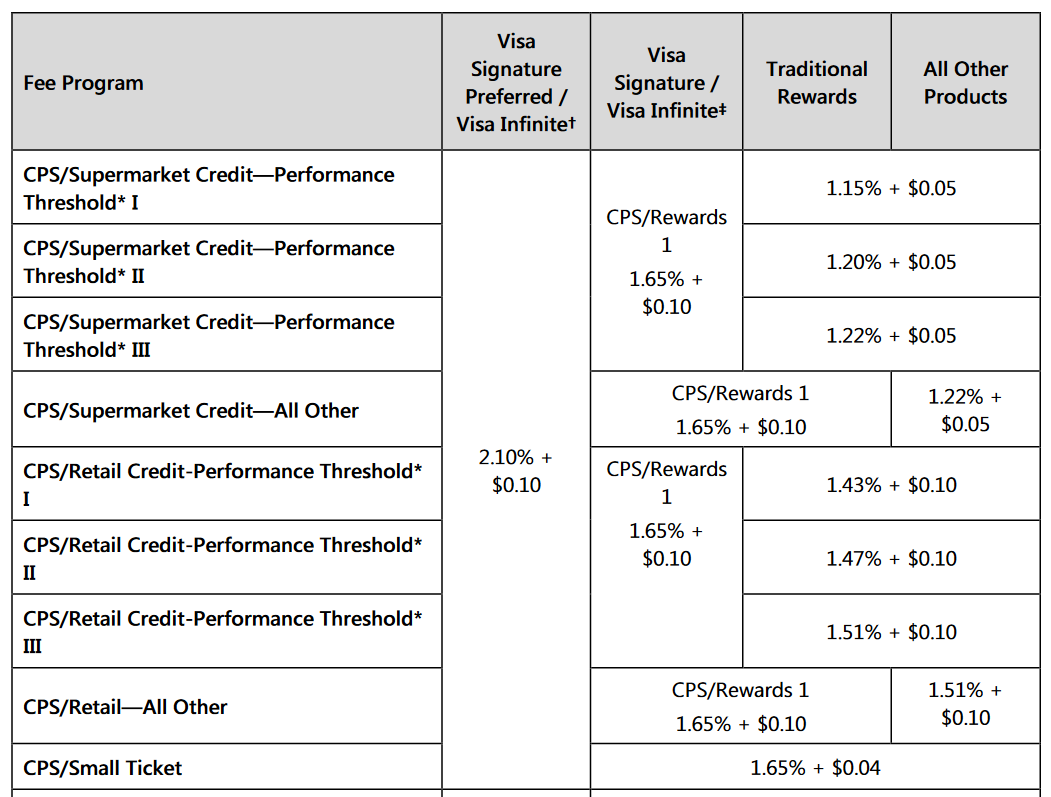

At the interchange level, card-present transactions typically cost less than card-not present transactions. For example, here is a snippet of Visa’s interchange rates for card-present transactions:

All of these categories are for “card-present” transactions. Even though there are additional criteria that determine which category a transaction will be routed to, they share an entry method. Transactions falling under these categories consist of swiped, dipped, or tapped cards.

Card Not Present Interchange Example

Compare that to this section of Visa’s interchange rates for card-not-present transactions:

Transactions charged according to these categories would not be swiped, dipped, or tapped. As you can see from the names on the left, one category is for cards that a retail business keys, one is a general card-not-present category, and then there are two ecommerce categories.

Without taking anything else into account (like processor markup), we can see that card-not-present transactions will cost more at the most basic level.

Pricing Model’s Role

Additionally, pricing model and processor markup play a role in costs. If you’re on an interchange plus pricing model, you’ll be charged the actual interchange cost for your transactions and a separate markup. In this scenario, your processor’s markup stays the same no matter what, but the higher interchange rate category means you’ll pay more.

On other pricing models, such as tiered pricing, your processor can simply choose to surcharge any transactions it wants to. You may see “non-qualified” rates on your statement for higher interchange category transactions.

Of course, if you’re legitimately accepting card-not-present transactions because it’s the standard (or only) way of doing so – like with ecommerce payments – then there isn’t much you can do about paying CNP rates.

However, if your processor charges CNP interchange because you’re keying in transactions even though a customer hands you their card, you could utilize a reader to lower your costs.

You’ll have plenty of choices – you can use a countertop credit card machine or full POS system, a card reader that attaches to your smartphone or tablet through a headphone jack or Bluetooth, or even a USB card reader that plugs in to your computer for use with a virtual terminal.

Chargeback Liability

Processors consider card-present transactions less risky. You can still be on the hook for chargebacks with card-present transactions, but your chances of chargeback liability with a card-not-present transaction may be higher.

The EMV liability shift of October 2015 dictated what happens with certain types of liability for EMV chip cards. In simplest terms, if your business doesn’t have an EMV capable credit card reader and you accept a chip card by swiping it through a magstripe reader, you’re liable for fraud that occurs. If you use a chip reader, fraud liability stays with the processor or bank.

Test Your Knowledge

Now that we’ve gone over what constitutes a card-present or a card-not present transaction, let’s see how it would play out in various common scenarios that your business may encounter. Read the following examples and make your guess, then check the answer to see if you’re correct.

Scenario 1:

Jen buys a vase at an outdoor antique show. She hands her credit card to the seller, who enters Jen’s card details into a secure payment app on a smartphone. The seller keys in Jen’s card number, name, expiration date, and the 3-digit CVV code and then hands Jen’s card back. Is this a card-present or a card-not-present transaction?

Answer: Card-not-present. Even though Jen physically handed her card to the seller, the seller keyed in the card information. There is no way to prove that the card was there at the time of the transaction, as electronic data wasn’t captured.

Scenario 2:

Samantha receives an electronic invoice for goods purchased by her company. She clicks on a secure payment link and sees a form for payment information. Samantha takes the company credit card from her purse, enters the card details, and completes the payment. Is this a card-present or a card-not-present transaction?

Answer: Card-not-present. While the card was with Samantha when she paid the invoice, it was never swiped through a card reader. Thus, no electronic data was captured.

Scenario 3:

Mike stops at his favorite coffee shop on the way to work. He pays for his latte by tapping his smartphone to the shop’s NFC terminal and leaves with his drink. He does not give a card or his phone to the cashier. Is this a card-present or a card-not-present transaction?

Answer: Card-present. Even though Mike didn’t use a physical credit card, his phone takes the place of the card. The phone provides electronic data at the time of the transaction.

Bottom line: If it’s possible to run cards through a reader (or enable contactless NFC payments) without inconveniencing your customers, it’s a good idea to do so. You may benefit from lower costs and more secure transactions.

Thanks for this great article. Just a few questions to clarify. I’ve read that verifying address info lowers fees. I have a vx520. I key in a card and it asks: CARD PRESENT or CARD NOT PRESENT.

If I press CP, it asks for:

1. Zip

2. V code

If I press Card Not Present, it asks:

1. address

2. Zip

3. V code

If keying in a card automatically designates the transaction as CNP, am I paying a lower rate by pressing “card present” or am I actually paying a higher rate because I am only entering the:

1. V code, and ZIP

vs

2. ADDRESS, V Code, and ZIP (with CNP)?

Which of the above is actually cheaper. This is a scenario that I run into frequently in my business.

If a card isn’t swiped/tapped, it’s always going to be card-not-present regardless of anything you do with the address. Card-not-present is more expensive than card-present. (And pressing “card present” doesn’t make it a card-present transaction.

Is there a reason you’re not swiping the cards? That’s both more secure and lower cost than keying in a card.

These are mostly phone orders. I guess i initially thought hitting card present when the terminal asks made the transaction cheaper. However, I’m only getting asked the below 2 questions if I hit CP.

1. Zip

2. V code

If I press Card Not Present, it asks:

1. address

2. Zip

3. V code

I guess the question would be, does entering the address info with the V code and zip make it cheaper.

It may, it may not. It depends on what category your transactions are qualifying for now/if they’re downgrading, the pricing model your current processor uses, and other factors. You’d need to check with your processor on the effect that AVS will have.

Thank you, this is an excellent article. I’m considering building a low cost charity donations terminal. Payers would tap their card on the terminal to read the card number and expiry only. I want to submit the transaction as a card not present transaction (without CVV), as it make the development of the terminal much easier, and there is little motivation for fraud (no goods or services to be stolen) where a charity donation is concerned.

I’m okay with the higher processing cost and fraud risk of the card not present transaction. Do you know of any card scheme rules which would stop me from taking this approach? Developing and EMV terminal will be costly. Charities don’t have the funds to buy an expensive terminal up-front, so I would like to go card not present to keep the cost down if possible.

Thanks in advance for your help.

Matt

Hi Matt,

Unfortunately, I don’t know anything about the manufacturing terminals side, so I wouldn’t be able to advise on that. Good luck!

Thank you, I am wondering why only regular payments (e.g. monthly ones with the credit card present the first time) have the card-present fee structure for all subsequent payments, as long as the payment is regular. Why can’t a non-regular payment, e.g., purchases at the same store 3 times a year w/ delivery after the first in-store card-present purchase not have the same fee as the first purchase. Thank you in advance.

“I am wondering why only regular payments (e.g. monthly ones with the credit card present the first time) have the card-present fee structure for all subsequent payments, ”

They don’t have the card-present fee structure for subsequent payments. Card-present only applies to transactions that are swiped/tapped/dipped. It does not apply to card-on-file payments, regardless of whether they’re regular or infrequent.

I hope this helps!

– Ellen from CardFellow