The Network Authorization Fee is an assessment charge that applies to all Discover authorization transactions.

Discover implemented the Network Authorization Fee in 2013 to replace the Data Transmission Fee, which applied to fewer transactions. The Network Authorization fee is often charged in tandem with the Discover Data Usage Fee. However, some processors only list one or the other. As of 2018, Discover sets the fee at $0.0025.

- What are assessment fees?

- Network Authorization Fee

- Difference Between the Network Authorization Fee and Data Usage Fee

- Locating the Network Authorization Fee

- Can I lower assessment fees?

What are assessment fees?

In credit card processing, assessment fees are one of three components of the total cost of a transaction. The other two are interchange fees and processor markup. The card brands set their assessment fees and collect them as profit, meaning the Discover Network Authorization Fee goes to Discover.

Discover assessment fees are non-negotiable, and the same for everyone. However, some processors may “pad” the fees in order to make more money while making it look like the fees are out of their hands. Be sure to find a credit card processor that passes assessments to you at cost.

Network Authorization Fee

As of 2018, Discover charges the NAF fee of $0.0025 for authorized Discover transactions. The fee is often charged in conjunction with the Data Usage Fee, but your processor may only charge one or the other.

Difference Between Network Authorization Fee and Data Usage Fee

Discover has two fees – the Network Authorization Fee and Data Usage Fee – that sound very similar. The Network Authorization fee applies to all transactions that are authorized on Discover’s network, while the Data Usage Fee refers to sending data over the Discover network and is charged for that.

Your processor can charge both fees on one transaction. It’s also possible or your processor to charge one fee and not the other, or for a processor to call the fees different things.

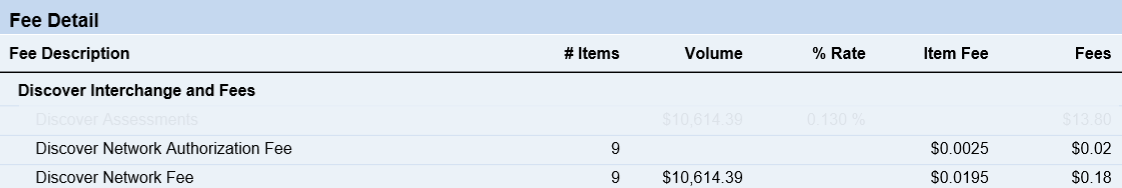

For example, the statement snippet below shows charges for both the Network Authorization Fee and the Data Usage Fee, but it refers to the Data Usage Fee as a “Network Fee.”

Locating the Discover Network Authorization Fee

Your processor may or may not list the fee on your statements. If you’re on an interchange plus or tiered pricing model, you’ll be able to see the fee if charged and listed. On a flat rate processing statement, you will not see assessments broken out.

The Network Authorization Fee will be located with other fees. In the snippet example below, the processor charged both the Data Usage Fee and Network Authorization Fee.

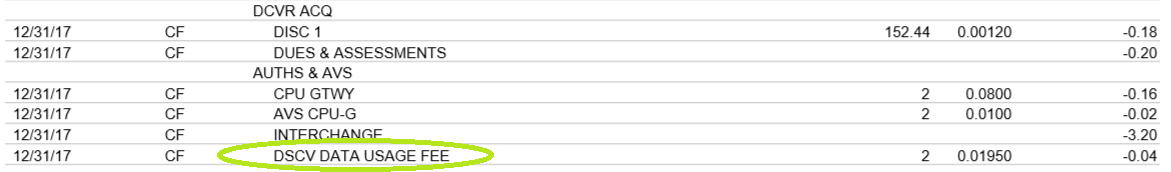

While a processor could charge the Network Authorization Fee and not the Data Usage Fee, it’s somewhat more common to see it the other way. Meaning, a business may see the Data Usage Fee and not the Network Authorization Fee. In the statement below, the processor listd the Data Usage Fee, but not the Network Authorization Fee.

Can I lower assessment fees?

No. Assessment fees are non-negotiable. However, it may still be possible to lower your overall credit card processing costs. At the beginning of this article, I mentioned that there are three components of credit card transaction costs: interchange, assessments, and processor markup. The first step to lowering costs for most businesses is to secure a more competitive processor markup. You can do that easily using CardFellow’s free quote comparison tools.

You’ll get instant, fully-disclosed quotes from leading processors to review at your convenience. If you need help comparing the quotes to your current processing, CardFellow’s experts are on hand to answer questions. It only takes 2 minutes to get quotes, and there’s no obligation. Try it now!