The “Acquirer License Fee” (ALF) is a Mastercard assessment fee that gets passed to businesses as part of the cost of credit card processing. The fee varies, but is often listed explicitly on processing statements. Let’s take a closer look at the fee and when it will be charged.

- Assessment Fees

- Acquirer License Fee (ALF)

- Locating the Acquirer License Fee on Statements

- Lowering Credit Card Processing Costs

Assessment Fees

As part of credit card processing costs, the credit card company sets the pricing themselves. Assessment fees apply to all business types and your credit card processor passes those charges to you.

The Acquirer License Fee is one of many different assessment fee, which you can expect to pay when you accept Mastercards at your business. Assessment fees can be ‘stacked,’ meaning that more than one fee can (and often does) apply to the same transaction.

Acquirer License Fee (ALF)

The Acquirer License Fee, also sometimes referred to as a License Volume Fee, varies for each acquirer, and is based on the acquirer’s portfolio of businesses. Mastercard doesn’t publish information on how it determines the ALF cost for acquirers.

The fee is typically very small – in some cases, fractions of a basis point. While the fee does vary from one acquirer to the next, it’s not usually a big difference. In fact, the different is usually around 1 – 2 basis points.

Locating the Acquirer License Fee on Statements

Locating the Mastercard Acquirer Licensing Fee on your statements requires looking through the line items individually. If you’re on an interchange plus or tiered pricing model, you will usually see the fee listed. On a flat rate pricing model, processors won’t list fees individually.

Processors use different terms for the ALF. Some processors refer to it as the Acquirer License Fee, some call it the License Volume Fee, others may list it as a License Rate. The variation in names and in the cost of the fee make it a little harder to locate than other assessments.

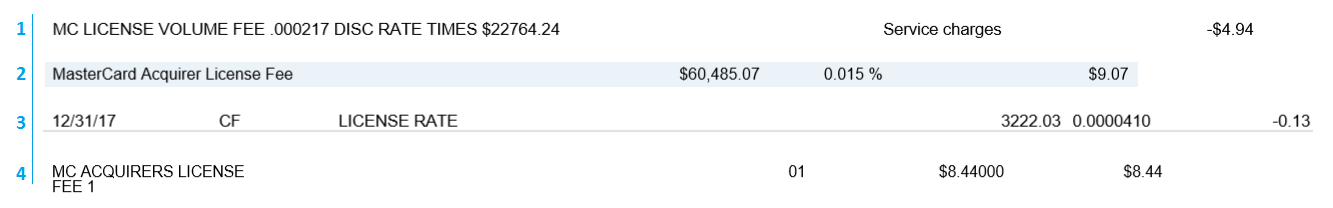

Below are 4 snippets from actual processing statements showing the Acquirer License Fee and how processors may list it on statements.

In the clearest case, the processor explicitly lists the fee as the Mastercard Acquirer License Fee and includes the fee rate and the total volume on which the fee was assessed, such as in the second snippet. The fee is clearly spelled out, the rate is listed as 0.015%, and it was assessed on $60,485.07 of volume, for a total fee of $9.07.

As you can see, the processor doesn’t always list the fee with the full name or with volume and rate. In snippets 1 and 3, the fee is called the “MC License Volume Fee” or the “license rate,” though both processing companies have included the rate and the volume. The fourth snippet refers to the fee clearly, as the MC Acquirers License Fee, but doesn’t provide volume or the rate for the fee, instead listing the total.

Your statement may have any combination of this information or it may not be included at all.

Lowering Credit Card Processing Costs

If your credit card processing is too expensive, there are possible ways to lower your costs. While assessment fees themselves aren’t negotiable, you can still look for a more competitive processor markup. A lower markup will reduce your overall costs.

Try a quote comparison tool to see baseline pricing specific to your business. CardFellow offers a free, no-obligation price comparison tool. If you need help comparing the offers to your current pricing, give us a call for assistance.