Enhanced data (also sometimes called level 2 or level 3 data) refers to information provided with a credit card transaction that goes beyond the basic details.

Providing level 2 / level 3 data can make a business eligible for enhanced data interchange categories, which carry lower rates and fees than non-enhanced categories. Enhanced data is only available for certain types of commercial card transactions, or B2B payments. It does not apply to consumer transactions.

B2B processing and enhanced data are specialty processing topics. If you’re not familiar with level 2 and level 3 data, be sure to read our guide to B2B transactions and enhanced data first.

You can also check out our article on interchange fees if you need a quick refresher on how interchange rates work.

- Enhanced Data Interchange Rates

- Qualifying for Enhanced Data Interchange

- Purchasing Large Ticket Interchange

- Purchasing Card – Large Purch Advantage Interchange

- Commercial Card Level II Data Rate Interchange

- Commercial Card Level III Data Rate Interchange

- How much less expensive are enhanced data categories?

- What happens if I don’t provide enhanced data?

Enhanced Data Interchange Rates

There are several enhanced data interchange categories, each with their own rate. However, it appears that there are more categories than there really are due to Visa separating some categories by spending. You can see that below with both the Purchasing Card – Large Purchase categories and the Business Card – Level II categories.

All rates come directly from Visa and are subject to change at Visa’s discretion.

| Volume Rate | Per-Transaction Fee | |

| Purchasing Large Ticket | 1.45% | $35.00 |

| Purchasing Card – Large Purch Advantage 1 | 0.70% | $49.50 |

| Purchasing Card – Large Purch Advantage 2 | 0.60% | $52.50 |

| Purchasing Card – Large Purch Advantage 3 | 0.50% | $55.50 |

| Purchasing Card – Large Purch Advantage 4 | 0.40% | $58.50 |

| Corporate Card Level II Data Rate | 2.50% | $0.10 |

| Purchasing Card Level II Data Rate | 2.50% | $0.10 |

| Business Card Level II Data Rate Spend Tier 1 | 2.05% | $0.10 |

| Business Card Level II Data Rate Spend Tier 2 | 2.05% | $0.10 |

| Business Card Level II Data Rate Spend Tier 3 | 2.05% | $0.10 |

| Business Card Level II Data Rate Spend Tier 4 | 2.20% | $0.10 |

| Corporate Card Level III Data Rate | 1.90% | $0.10 |

| Purchasing Card Level III Data Rate | 1.90% | $0.10 |

No, those $35.00 and up transaction fees aren’t typos. On large purchases, it’s a better idea to take a higher per-transaction fee in exchange for a lower percentage fee.

Large Purchase Advantage Thresholds

The current thresholds for the large purchase advantage categories are as follows.

| Transaction Amount | |

| Large Purch Advantage 1 | $10,000.01 – $25,000.00 |

| Large Purch Advantage 2 | $25,000.01 -$100,000.00 |

| Large Purch Advantage 3 | $100,000.01 – $500,000.00 |

| Large Purch Advantage 4 | $500.000.01 and higher |

Thresholds subject to change at Visa’s discretion.

Business Spend Tier Thresholds

The current thresholds for business spend tiers are as follows.

| Spend Tier 1 | $0 – 19,999.99 |

| Spend Tier 2 | $20,000 – 39,999.99 |

| Spend Tier 3 | $40,000 – 99,999.99 |

| Spend Tier 4 | $100,000 and up |

Thresholds subject to change at Visa’s discretion.

Qualifying for Enhanced Data Interchange

Receiving enhanced data interchange rates is not automatic. You’ll need to be properly set up to provide level 2 or level 3 data at the time of the transaction. Fortunately, there are gateways that streamline the process by auto-populating the relevant fields.

It’s not realistic to assume you can get enhanced data rates for all of your commercial transactions, but it’s possible to secure those rates for the bulk of them.

However, providing enhanced data isn’t the only requirement. You’ll also need to meet criteria that applies to the various categories. Some criteria is the same across a few different categories, while other requirements are category-specific.

Visa Custom Payment Service (CPS)

The enhanced data interchange categories will reference CPS qualification as one of the requirements. CPS refers to Visa’s “custom payment service” programs, which detail specific requirements for transactions. Meeting the requirements of a CPS program means that a transaction is “CPS qualified.” For example, if a transaction meets every requirement laid out in the CPS / Restaurant program, that transaction is said to be CPS qualified for CPS / Restaurant.

In the criteria for enhanced data categories, we’ll specify which CPS program qualifications are eligible for which categories. You can also read more about Visa CPS.

Purchasing Large Ticket Interchange

Applies to purchasing credit cards.

The purchasing card large ticket interchange category has multiple requirements. Missing any of the criteria will cause the transaction to “downgrade” to a more expensive interchange category. The requirements include:

- A minimum transaction amount of $7,755.56

- Settling the transaction within 7 days

- Providing level 2 and level 3 data

- Meeting CPS qualification for CPS / Retail, Key Entry, Supermarket, Service Station, CNP, Ecommerce Basic, or Ecommerce Preferred

- Accepting the card at an eligible business

For the purposes of this category, ineligible businesses include those in travel & entertainment, such as restaurants, lodging, car rentals, and other types of transportation, such as airlines.

The transaction must also occur with an eligible purchasing credit card.

On statements: You may see this interchange category abbreviated as PUR LG TK on processing statements.

Purchasing Card – Large Purch Advantage Interchange

Applies to purchasing credit cards.

The largest individual transactions made with purchasing cards may be eligible for large purch advantage interchange. In addition to the transaction minimums noted in the table earlier in this article, the transaction must:

- Be settled within 7 days

- Be CPS qualified for CPS / Card Not Present, CPS / Ecommerce Basic, or CPS / Ecommerce Preferred

On statements: Different processors use different terms and abbreviations to label interchange on monthly statements. You may see this category listed as PURCH LPA1, PURCH LPA2, PURCH LPA3, or PURCH LPA4, depending on the tier. However, it may also be called another name.

Commercial Card Level II Data Rate Interchange

Applies to corporate, purchasing, and business cards.

The commercial card level 2 data rate category will apply when you accept a commercial corporate, purchasing, or business card, and meet the following criteria:

- Eligible business type

- CPS Qualified

- Provide Level II data

For data rate II, businesses in the travel and entertainment sector are not eligible. That includes restaurants, hotels, car rentals, and passenger transportation, such as airlines, cruises, and trains.

CPS qualification refers to meeting requirements for Visa’s “custom payment service” programs. The CPS programs outline specific criteria. If your transaction meets the criteria, it will be considered CPS qualified.

Required level 2 data includes a valid sales tax amount and sales tax indicator, as well as a customer code. Sales tax cannot be 0 – It must be between 0.1% and 22% to qualify. However, purchasing card transactions that occur at a gas station do not require sales tax to be included.

Level 2 on processing statements: If you qualify for level 2 data rate interchange, you may see it listed on your monthly processing statement as something like:

- USCOMML2 (for “US commercial level 2”)

- USCOMML2P (for “US commercial level 2 purchasing”)

- USCORPL2 (for “US corporate level 2”)

However, not all processors use the same names or abbreviations. Your processor may call level 2 transactions by other names.

Commercial Card Level III Data Rate Interchange

Applies to purchasing and corporate credit cards.

For achieving commercial card level III interchange, your transactions must:

- Take place at an eligible business

- Provide level III data

- Meet CPS requirements for: CPS / Retail, CPS / Small Ticket, CPS / Retail Key Entry, CPS / Supermarket, CPS / Retail Service Station, CPS / Card Not Present, CPS E-commerce (Basic or Preferred)

Once again, travel and entertainment businesses (hotels, car rental, restaurants, airlines, trains, etc.) are not eligible for this category.

Level III data requirements include line item detail, such as item description, item quantity, unit of measure, freight or shipping amount, product code, unit cost, and more. If you take a lot of commercial cards and aren’t in a travel / entertainment business, it’s a good idea to work with a processor that specializes in enhanced data in order to qualify for these enhanced interchange categories.

On statements: You may see commercial card level III data interchange listed as COMM L3 C (commercial level 3 corporate), COMM L3 P (commercial level 3 purchasing) or other names.

How much less expensive are enhanced data categories?

So, the real question: are enhanced data categories actually that much cheaper? They certainly can be. Enhanced data categories can be as much as 1.05% lower than non-enhanced categories. As a business owner, you know processing fees can add up quickly. When it comes to commercial cards, shaving one percent off your interchange costs can add up to significant money over time.

What happens if I don’t provide enhanced data?

First of all, you’re not required to provide enhanced data. Even if you accept a lot of commercial transactions, it’s your decision if you just want to provide basic information. However, doing so means leaving money on the table.

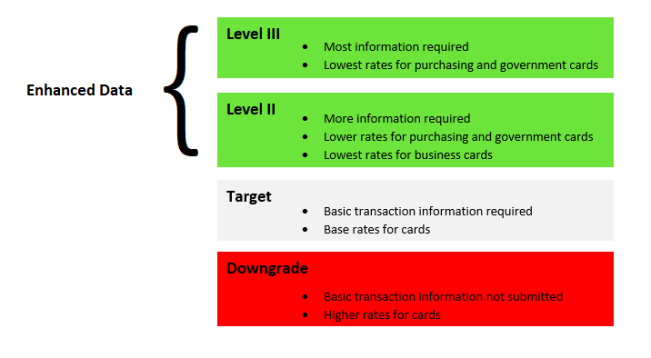

If you don’t provide enhanced data but do meet basic qualifications, your transactions will hit “target” interchange. For commercial transactions, target is the middle of the road. You’re not receiving the best possible rates (enhanced interchange) but you’re also not receiving “penalty” rates (downgrades.)

However, if you don’t meet the requirements for target interchange, your transactions can still downgrade. The difference in cost between a commercial downgrade and an enhanced interchange category can be significant – a full percent or more. Providing enhanced data will save you money. Fortunately, there are also systems that can help streamline the process, so it won’t cause headaches to save.

Not sure how to get started providing level 2 and level 3 data? CardFellow members can contact us for assistance. Our processing experts will answer questions about qualifying for enhanced data and can even provide a statement analysis showing the cost difference.

Not a CardFellow member yet? It’s free and sign up only takes a minute. Become a member now or give us a call to talk to one of our processing experts about the benefits of membership.