Visa’s International Acquirer Fee is one of several assessment fees that apply to Visa transactions. It often applies in conjunction with the International Service Assessment (ISA) Fee.

Despite how it sounds, you may incur the international acquirer fee even if you don’t think you take international payments. That’s because the fee applies to transactions in the United States made with cards issued outside of the United States. If a foreign customer uses their card at your business, the fee will apply.

Visa began charging this fee in October of 2009. Currently, you’ll pay 0.45% (forty-five basis points) for transactions acquired within the United States involving a card issued by a bank outside of the United States. The International Acquirer Fee (IAF) is one of two assessment fees that Visa now charges for this type of transaction, so your actual fees can be higher than the 0.45% IAF.

- Visa Assessment Fees

- International Acquirer Fee

- IAF on Credit Card Processing Statements

- How to Lower Credit Card Processing Costs

Visa Assessment Fees

Assessment fees are how Visa makes money. Whenever you take a Visa card at your business, the transaction incurs assessment fees from Visa, which your credit card processor passes to you. Assessment fees are the same for every processor; they are not negotiated with Visa for individual businesses.

However, there have been examples of processors “padding” assessment charges without disclosing it to businesses. Indeed, Mercury Payment Systems was sued for that practice. Ideally, you’ll work with a processor that passes assessments to you at cost.

CardFellow clients don’t have to worry. Our legal agreement with processors stipulates that the processor pass charges to you at cost. Furthermore, we monitor your statements twice a year to ensure you’re billed correctly. Haven’t had a statement audit done recently? Log in to your CardFellow account to set up an audit.

International Acquirer Fee

As noted earlier, the IAF applies to transactions in the United States with credit cards issued by banks outside the United States. It can apply to both card-present (swiped) transactions and card-not-present (ecommerce or phone) transactions. If you have a lot of foreign customers (either tourists making in-person purchases or foreign clients purchasing online) you’ll see the IAF regularly.

Currently, Visa sets the International Acquirer Fee at 0.45% of the transaction total. Assessment fees can be layered, meaning you’ll often pay more than one assessment fee on a single transaction. The IAF frequently occurs with Visa’s international service assessment. While they’re separate fees, both apply under the same circumstances.

The International Acquirer Fee (0.45%), International Service Assessment (0.80%), and Visa’s standard assessment (0.11%) will all apply to transaction involving a credit card issued outside of the United States, bringing the total charge (beyond interchange) to 1.36%.

The international assessments are higher than other Visa assessment fees, partially due to the increased risks and complexity of international payments. Read more about international credit card payments.

IAF on Credit Card Processing Statements

The International Acquirer Fee may or may not be present on your statements. Remember, it only applies when you accept a card that was issued by a non-US bank. Additionally, your processor has control over what information you’ll see on statements. Even if you’re charged the fee, you may not always see it listed as its own line item.

That will also be true if your processor lumps multiple fees together. If that’s the case with your statement, you won’t see the IAF listed individually. Other processors, like those that use flat rate pricing, don’t show you any fee detail for interchange or assessments.

However, if you’re on interchange plus or tiered pricing and accept a Visa card issued outside of the United States, you may see one or both of the Visa international assessments. You can look for the fee by name or variations of the name in the Visa charges section of your processing statement. The processor will also typically list the rate charged and the amount to which the fee applied.

Examples

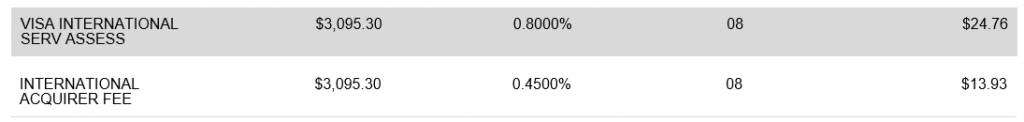

Fortunately, processors often list the international fees, such as the IAF, by an easily understandable name. In the two statement snippets below, the processor lists the international acquirer fee clearly.

![]()

In the first snippet, the processor abbreviated the fee, but it’s still recognizable. The second processor spells out the entire fee name. In both cases, the processor lists the total transaction volume to which the fee applied, the rate, and the total charge to the business.

In the first example, a rate of 0.00450 (the decimal version of 0.45%) applied to $2,677.55, resulting in a $12.05 charge to the business. Since Visa sets the fee at 0.45%, this processor is passing the assessment fee at cost. If you wanted to check the math, you could simply multiply 2677.55 * 0.0045 to see the total 12.048975, which rounds to 12.05.

Reminder: CardFellow clients won’t need to check assessments individually, as we review your statements for you.

In other cases, you’ll see both the international acquirer fee and the international service fee. The statement snippet below shows a processor passing both fees at cost. (Note that the fees may not be listed next to each other on your actual statement, so you’ll need to check all lines.)

Remember, while both fees can apply to one transaction, you may only see one or the other listed, or your processor may lump them together as a general international service fee. If you have questions about the fees your processor charges, be sure to ask.

How to Lower Credit Card Processing Costs

For many businesses, the important question is, “How do I lower my credit card processing costs?” If reducing costs if your priority, assessments aren’t really where you’ll need to focus. Instead, the first place to look is at the processor’s markup. That’s the only component of cost that’s negotiable and one of the easiest ways to slash your pricing.

It’s a good idea to have a solid understanding of how credit card processing works, but you can also take advantage of helpful tools to do the legwork for you. The easiest way to go about reducing costs is to use CardFellow’s free price comparison tool. You simply fill out a 2-minute form to receive instant quotes for credit card processing. You can optionally invite additional quotes from any processor you’d like, and our software will show you how the quotes stack up.