It isn’t necessary to have intimate knowledge of the inner-workings of the bankcard system in order to find the best credit card processor. But, it’s a good idea to have a general understanding of how credit card processing works because fees are incurred at various stages of the system.

Knowing the lay of the land will help you better identify how to get the best processing solution. Once you’re done reading this article, check out our more detailed breakdown of where credit card processing fees come from.

For now, let’s dive in to how credit card processing works.

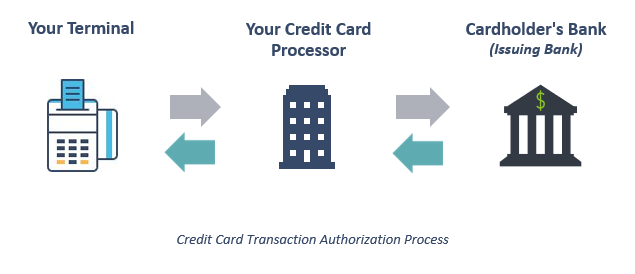

The bankcard networks that ferry billions of transactions between merchants (businesses), processors and banks are truly modern marvels. In just a matter of seconds, your terminal passes transaction information to a processor, and then through the card network to the issuing bank for approval. The issuing bank then sends an authorization back through the card network to your processor before it finally ends up back at your terminal or software.

As involved as the system sounds, obtaining an authorization for a transaction is just the first step. Authorizations must be settled before sales can be deposited into you business’s bank account. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at each stage, and a failure (or partial failure) in either step can result in increased costs and/or credit card sales not being deposited.

As involved as the system sounds, obtaining an authorization for a transaction is just the first step. Authorizations must be settled before sales can be deposited into you business’s bank account. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at each stage, and a failure (or partial failure) in either step can result in increased costs and/or credit card sales not being deposited.

How Credit Card Processing Works: Key Players

The key players involved in authorization and settlement are the cardholder, the merchant (that is, the business accepting the card), the acquiring bank (the business’s bank), the issuing bank (the cardholder’s bank), and the card associations (Visa and Mastercard.)

Cardholder

If you have a credit or debit card (as most of us do), you’re already familiar with the role of the cardholder. But just to be thorough — a cardholder is someone who obtains a bankcard (credit or debit) from a card issuing bank. They then present that card at a business to pay for goods or services.

Merchant

Technically, a merchant is any business that sells goods or services. But, only merchants that accept cards as a form of payment are pertinent to our explanation. So with that said, a merchant is any business that maintains a merchant account that enables them to accept credit or debit cards as payment from customers (cardholders) for goods or services provided. You as a business owner are a merchant. A common misconception is that the merchant is the processor. It comes from confusion around the term merchant services. But what that really means is services provided to you, a merchant.

Acquiring Bank (Merchant’s Bank)

An acquiring bank is a registered member of the card associations (Visa and Mastercard). An acquiring bank is often referred to as a merchant bank because they contract with merchants (businesses) to create and maintain accounts (called merchant accounts) that allow that business to accept credit and debit cards. Acquiring banks provide merchants with equipment and software to accept cards and handle customer service and other necessary aspects involved in card acceptance. The acquiring bank also deposits funds from credit card sales into a merchant’s account.

Interestingly enough, many merchants don’t recognize their acquiring bank as the primary provider of their merchant account. Acquiring banks are playing an increasingly hands-off role as the bankcard system evolves. Acquiring banks often enlist the help of third-party independent sales organizations (ISO) and membership service providers (MSP) to conduct and monitor the day-to-day activities of their merchant accounts.

Issuing Bank (Cardholder Bank)

As you’ve probably guessed, an issuing bank issues credit cards to consumers. The issuing bank is also a member of the card associations (Visa and Mastercard).

Issuing banks pay acquiring banks for purchases that their cardholders make. It is then the cardholder’s responsibility to repay their issuing bank under the terms of their credit card agreement.

Card Associations (Visa and Mastercard)

Visa and Mastercard aren’t banks and they don’t issue credit cards or merchant accounts. Instead, they act as a custodian and clearing house for their respective card brand. They also function as the governing body of a community of financial institutions, ISOs and MSPs that work together in association to support credit card processing and electronic payments. Hence the name, “card associations.”

The primary responsibilities of the Card Association are to govern the members of their associations, including interchange fees and qualification guidelines, act as the arbiter between issuing and acquiring banks, maintain and improve the card network and their brand, and, of course, make a profit. That last one has become even more important now that Visa and Mastercard are public companies.

Visa uses their VisaNet network to transmit data between association members, and Mastercard uses their Banknet network.

Credit Card Authorization

In the authorization process, all of the parties noted above play a role.

Cardholder

A cardholder begins a credit card transaction by presenting his or her card to a merchant as payment for goods or services.

Merchant

The merchant uses their credit card machine, software, or gateway to transmit the cardholder’s information and the details of the transaction to their acquiring bank, or the bank’s processor.

Acquirer / Processor

The acquiring bank (or its processor) captures the transaction information and routes it through the appropriate card network to the cardholder’s issuing bank for approval.

Visa / Mastercard Network

Mastercard transaction information is routed between issuing and acquiring banks through Mastercard’s Banknet network. Visa transactions are routed through Visa’s VisaNet network.

Issuer

The credit card issuer receives the transaction information from the acquiring bank (or its processor) through Banknet or VisaNet and responds by approving or declining the transaction after checking to ensure, among other things, that the transaction information is valid, the cardholder has sufficient balance to make the purchase and that the account is in good standing.

Visa / Mastercard Network

The card issuer sends a response code back through the appropriate network to the acquiring bank (or its processor).

Merchant

The response code reaches the merchant’s terminal, software or gateway and is stored in a batch file awaiting settlement.

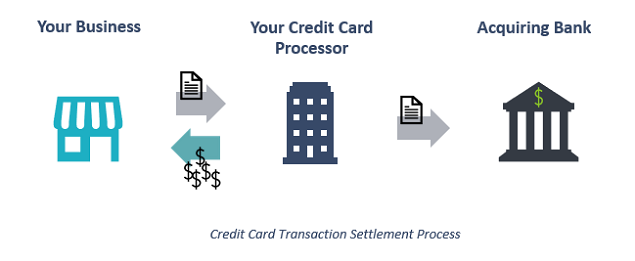

Credit Card Clearing and Settlement

The second part of how credit card transactions work is clearing and settlement. This occurs after the authorization process takes place. For settlement, the merchant (that’s you) sends a “batch” of authorizations to your processor, typically once per day. The processor reconciles the authorizations and submits the batch over the card association networks. The processor also deposits the funds from those sales into the business’s bank account and deducts processing fees. At that point, the business’s role is complete.

The issuing and acquiring banks continue to communicate and move money (with the issuing bank paying the acquiring bank for the cardholders’ purchases) and the cardholder eventually pays the issuing bank. Neither of those steps involves your business.

The issuing and acquiring banks continue to communicate and move money (with the issuing bank paying the acquiring bank for the cardholders’ purchases) and the cardholder eventually pays the issuing bank. Neither of those steps involves your business.

Merchant

A merchant(business) begins the settlement process by sending a batch of approved authorizations to their acquiring bank (or the bank’s processor). Authorization batches are typically sent at the close of each business day. Multiple individual credit card transactions make up a batch.

Acquirer

The acquiring bank (or its processor) reconciles and transmits the batch of authorizations through interchange via the appropriate card association’s network (VisaNet or Banknet).

The acquiring bank also deposits funds from sales into the merchant’s bank account via the automated clearinghouse (ACH) and debits the merchant’s account for processing fees either monthly, daily, or both depending on the merchant’s processing agreement.

Card Network

The card association debits the issuing bank’s account and credits the acquiring bank’s account for the net amount of the authorizations which is gross receipts less interchange and network fees.

Issuer

The card issuing bank essentially pays the acquiring bank for its cardholder’s purchases.

Cardholder

The cardholder is responsible for repaying his or her issuing bank for the purchase and any accrued interest and fees associate with the card agreement.

Funding and Fees

In the explanation of settlement and clearing above, I noted that the processor will deposits the funds from your credit card sales into your business bank account and deduct processing fees. However, there are some variations on exactly how fees are deducted, and when funds are deposited.

Credit Card Deposits

These days, most processors offer next day funding, meaning that you’ll receive money for today’s credit card transactions tomorrow. The caveat is that you must “batch” your transactions by a specific cutoff time in order to receive the funds the next day. If you miss the cutoff, you won’t receive funds until the second business day.

In some cases, processors may hold your funds if they suspect fraud or otherwise determine that a transaction is too risky. In those cases, you will not immediately see the funds.

Credit Card Fee Deductions – Discounting

There are two primary methods that processors use to deduct credit card fees from your transactions. The methods are called daily or monthly discounting.

Daily discounting involves the processor deducting processing fees each day, before depositing your funds. This means that you receive the net sale amount, or the amount after fees. With monthly discounting, the processor deducts processing fees for an entire month’s transactions once per month but deposits funds daily. This means that you receive the gross sale amount, or amount before fees, each day.

There are pros and cons to both methods, and many processors let you choose which discounting timeframe you’d like. You can read more in our post on daily vs. monthly discounting to help determine which method is right for your business.

The amount of processing fees you’ll owe varies depending on a number of factors, including the processor you use, the pricing model you’re on, and your processor’s markup. If you need help securing low cost processing with great service, join CardFellow’s wholesale credit card processing club. You shop the same processors but with better terms and better member rates. Best of all, membership is free! Join here.

I recently was contacted by a Dave Roberts, Director of Programs, Processing Division of Visa/MasterCard with an offer to set up a website which will allow me to send emails to small business, telling them that if they switch to Visa/MasterCard direct processing, instead of their current processor of credit/debit cards, they could save approximately 5% of their current processing fees. Mr Roberts also claimed that by directing these businesses to his website, I would receive a commission for every business who converted to his processor. What I want to know is, am I being scammed? He claimed I needed to have a $1,000 credit line with either Visa or MasterCard to set up my home based business or sending out emails to the businesses he would provide me to contact. He claimed the $1,000, credit line I would need was for a licence to do this referral business, as well for the website he would set me up with.

Hi Colleen,

I definitely would not get involved with this, as it is almost certainly a scam. I’d advise calling Visa and MasterCard directly if you have questions or to report the situation.

Recently every time I purchase gas from HEB, my bank account has $100 frozen(‘a hold is put on’). The amount is unavailable to me for at least 5 days. My account is debited for the amount of gasoline I put in my tank and I am without access to $100 of my money for at least 5 days. I have tried entering the transaction as Debit and Credit, both with the same result.

To me this is stealing, as I did not give express permission to anyone to ‘hold’ my money.

The bank insists that it is the merchant who is doing this and the merchant insists that it is the bank. What is the truth? No one here seems to know.

It’s the merchant who dictates the transaction type and amount. Use a different gas station.

It appears that the states which host most merchant accounts(acquiring banks) include South Dakota & Delaware. Is their a reason merchant bank accounts are located in these states as opposed to a bank near the merchants locations?

Hi Howard,

Processors have relationships with acquiring banks; the merchant’s location is mostly irrelevant. The location of a settlement bank only matters to the business when trying to clear batches before the end of day (in the bank’s time zone) to receive funds faster.

I recently used a credit card at a restaurant. When I received the bill, the amount charged was $5 different from the receipt I had. I filed a dispute, and the credit card company issued a $5 credit, so everything was made okay. I am just wondering where the “mistake” lies: merchant or credit card company?

Hi Bev,

We can’t say with certainty, but most likely the merchant. Sometimes, incorrect totals are entered when the checks are adjusted for tips.

Hi Ben,

The mouse over resource don’t work.

Thanks for the comment, Marcio. We’ll check into this.

There’s also more to think about than just credit card processing fees.

You have to think about the “gravy” the processor gets by charging you for extra services and fees you probably don’t require. If you don’t keep a close eye on this you could be paying hundreds of unnecessary dollars a year or month. But I believe at least Card Fellow helps in this area by watching your statements, and hopefully they watch more than just interchange rates.

As an example, I’m in the process of signing up with a processor through Card Fellow right now. I read the terms before signing and noticed I would have been signed up for a monthly fee for a “security breach” protection service they provide where they cover you for a lot of money if your credit card data or network is ever breached. But, I have a standalone credit card machine using dial-up. I don’t and cannot store any card data for a breach. Heck, even with EMV I don’t even think the CC# gets transmitted over the phone line anyway, just authentication codes.

So I encourage everyone to view their statements closely EVERY month.

My previous processor is famous for slipping in extra “fees” for nothing. Sometimes even auto opt-in me for services I don’t need. I’d have to call to opt-out so I could keep my money. The last straw that made me leave was as of July 1, 2017 they wanted to charge every merchant of theirs a monthly fee of $7.50 for charge backs, even if you never get one or never had one in the years of service with them. They really had no excuse for me when I asked what that was for. How sneaky and appalling is that? Really. I get to pay for all the people in the world who do charge backs to other companies I don’t even know. Just wrong.

Ellen, I use a cc machine at my business and recently a customer was charged even though she hasn’t seen me in a month. I am the only one who uses the machine and save no numbers, as it is dangerous. I called my cc company and they said the machine doesn’t save cc numbers; how is she getting charged? Losing clients is not going to help my business.

Hi Kelly,

For whatever reason, there must have been a transaction sent through. I’d suggest contacting your processor to see if they can provide more details about the transaction.

Mouseover is still not working.

Hi Brian,

Yes, we’re aware of the issue. We’re working on a new platform, so it will likely be updated at that point.

I purchased services for a custom made kitchen counter top from a merchant and was required to pay one half of the total price with a deposit. I paid the deposit with my Visa credit card. The merchant charged me an additional 3% for using a credit card. I had never heard of the like. Surely this merchant is fleecing me on these charges. Is this legal?

Hi Sandra,

It may be legal. Some states prohibit it, though others don’t. We have more details in our article on surcharging: https://webdevfolio.com/cardfellow_live_9102023/blog/checkout-fees-charging-credit-card-fees-to-customers/

I find this article very insightful. I really made lots of things clearer. But I would like to know how a company can be part of the Visa Network or MasterCard’s Network so that they company can make their own cards.

Hi Jimmy,

Visa and Mastercard don’t issue cards directly, banks do. You would need to work with a bank.

Great article Ben, but could one argue that it’s a 3-stage process? Or would you have ‘clearing’ as a subset of Settlement?

Hi Connor,

Yeah, we’re grouping clearing and settlement as one stage, since they’re essentially part of the same process.

I sell on a wholesale e-commerce marketplace site powered by STRIPE as payment processor. I am one of many “connected accounts, or vendors”. I just received my 1099-k and the gross transaction amount listed is hundreds of thousands more than my gross sales amount (even taking into account all fees, refunds, etc.) for the year. When I asked the reason for the huge discrepancy, I was told it’s because Stripe calculates the PRE-AUTHORIZED amounts, not the actual card CAPTURED (charged) amounts. We routinely obtain pre-authorizations (like hotels and gas stations) that exceed the actual charges, to cover extras, shipping charges, and before we start the packing process, so the pre-authorized amounts are $100-$200 higher than actual captured amounts.

I was told Stripe recognized the authorization amounts for the 1099-k, and treated the difference with the actual card capture amounts as “refunds”. This method of reporting seems highly improper, at the very least unheard of, by any other platform or card processor, i.e. Amazon, Ebay, Etsy, etc. Can they legally do this? Do I have any recourse? They have tremendously over-inflated my gross sales.

Thanks for any insight or referral to any expert advice.

Hi Kevin,

Unfortunately that’s out of our area of expertise. I’d suggest checking with a CPA or a business attorney for the most accurate information on how to handle that.

What exactly is included in the “transaction information” that ultimately ends up in the issuing bank’s system when the card holder makes a purchase at a merchant’s POS register. In particular, if a retail establishment is a grocery store but also includes a pharmacy, is it reasonable to expect the issuing bank to provide the cardholder with enough information to distinguish between a purchase made from the pharmacy and one made from the general checkout registers at the front of the store? Does the transaction information identify the register that processed the card? If you have time to respond, please send a copy to my email address.

Hi Peter,

Unfortunately, there’s no way to answer that, as different businesses will have things set up differently. The pharmacy may or may not have a separate merchant account, for example. Your best bet would be to talk to the store directly with any specific questions about the info they receive / provide from transactions.

I hope this helps!

– Ellen from CardFellow

I filed a dispute with a travel company and then dropped the dispute because the company offered to settle for “X” amount of the dispute. I emailed the company the letter from my credit card company showing that the dispute was dropped and the case was closed.The company still refuses to reimburse me for the amount agreed upon because it is not in the Visa system yet. And if it is not in the company’s central payment office by July 19th, the travel agency will be credited with the amount they agreed to reimburse? What can I do?

Hi Susan,

It’s not uncommon for companies to try to get you to drop disputes, but if it’s a legitimate dispute, it’s better to go through the card company. Since the dispute is already closed, you may want to talk to a lawyer about your options. Good luck!

– Ellen from CardFellow

This is a follow-up to your response to me of July 3, 2019. Ben Dwyer’s article defines one of the Merchant’s roles with these words: “The merchant uses their credit card machine, software or gateway to transmit the cardholder’s information and the details of the transaction to their acquiring bank, or the bank’s processor.” Surely there must be some system standard that defines exactly what data makes up “the details of the transaction”. Obviously, the dollar amount would be included. It also sounds reasonable that some identifier of the specific point of sale device (i.e., the register, credit card machine, etc.) would be included, if for no other reason than having the ability to trace the exact origin of the transaction. Your reply suggests that the level of detail ends with the merchant’s account number. Considering that the printed receipt given to the card holder at a typical register includes so much more information (even the cashier’s name!), it seems a Point of Sale device ID must exist in the merchant’s basic data collection. It is hard to imagine that the credit card processing system at large would miss the opportunity to take in as much of the available information as possible; if not for forensic purposes, then for marketing purposes. Do you know of any source for the standards that govern the details of what data is included in the information that shuttles around the system during the many steps of a credit card transaction? Thank you.

Hi Pete,

“Your reply suggests that the level of detail ends with the merchant’s account number.”

Not that it ends with the merchant’s account number, but that the information with transactions is partly dependent on the merchant’s set up. In your initial example, you asked if a grocery store purchase would be differentiated from a purchase made within a grocery store pharmacy. It may or may not be easily discernible, depending on whether those locations have one MID or separate MIDs. There are often device IDs for different machines, yes. Again, those are things that the merchant can set up and change.

The best bet for getting specific information about a transaction is to contact the store directly. I hope this helps!

– Ellen from CardFellow

Great Article. I really like the way you have listed out the players and the roles that they play so clearly. I have often seen articles where they unnecessarily make this ecosystem look even more complicated than what it is.

This is great, thanks! I now understand the basics 🙂