Most businesses deal with a chargeback at some point. When a customer is not satisfied with a purchase, they dispute that purchase through their credit card issuer, asking for the money to be refunded.

Customers dispute transactions for many different reasons. When you disagree that a chargeback is warranted, you’ll need to fight that chargeback through your credit card processor. However, processors each have their own methods for notifying you of chargebacks and for requesting documentation to support your claim.

In this article, we’ll go over what to expect when you receive a chargeback so that you have a better understanding of your responsibilities and obligations. Remember, though, that chargeback disputes must go through your processor. You’re not able to directly contest the chargeback yourself.

Note that this article doesn’t focus specifically on reasons for chargebacks or tips on preventing them. For that information, check out our guide to chargebacks. Instead, we’ll focus on what happens after you receive a chargeback.

Additionally, this article only discusses chargebacks that occur when a customer uses a Visa or Mastercard. For the other card brands, check out Discover or American Express chargebacks.

- Stages of a Chargeback

- Receiving a Chargeback

- Representment – Disputing a Chargeback

- The Chargeback Process

- Visa Chargeback System

- Mastercard Chargeback System

- Chargeback Verdict

- Card Brand Arbitration

- If a customer wins a chargeback, am I out the money and the product?

Stages of a Chargeback

There are a few possible ‘stages’ involved in credit card disputes. In some cases, a dispute may not progress to a full chargeback. In other cases, it may go all the way to the card brands for a decision.

Dispute with Retrieval Request – In this initial phase, the issuing bank (the bank that provided the customer with the credit card) will seek more information about a cardholder’s disputed transaction. Some disputes end at this stage, especially if the customer disputed an unrecognized transaction and then remembers the transaction after receiving more information.

Cost to you: Retrieval Fees set by your credit card processor. Commonly starting at $10 per retrieval request.

Chargeback – A dispute that moves forward for a decision by the bank. Businesses can choose to fight the chargeback.

Cost to you: Chargeback Fees set by your credit card processor. Commonly starting at $15 per chargeback.

Arbitration – When one party disagrees with the chargeback ruling, they can choose to appeal it to card brand arbitration.

Cost to you: Varies by card brand, but expect to pay several hundred dollars if you pursue arbitration.

Receiving a Chargeback

There are many reasons a customer may initiate a chargeback. Commonly, if they don’t receive the item or receive a different one than expected, they may dispute the charge. This is particularly true if they first contact you and can’t secure a refund or exchange.

Customers may also initiate disputes if they don’t recognize a purchase and believe it to be unauthorized. In some cases, unscrupulous customers initiate chargebacks on purchases they did authorize, with the intent of getting both the item ordered and their money back.

Banks request that customers attempt to resolve a dispute with your business before initiating a chargeback. If a customer contacts you and is not satisfied, it’s a good idea to try to work with the customer to reach an agreement that works for you both. A customer may be willing to exchange the product or accept store credit. Even if you have to issue a refund to keep the customer happy, doing so freely (as opposed to having the money deducted from your account by your processor and returned to the customer) is still a better idea. Working with the customer to reach a satisfactory compromise can help you avoid the chargeback process completely.

As noted above, if you receive a chargeback, you’ll also receive a chargeback fee – often costing $15 – $25 per occurrence. Chargeback.com maintains a list of chargeback fees for multiple processors.

Representment – Disputing a Chargeback

In some cases, you may find that you’ve received a chargeback that you believe to be invalid. Perhaps the customer issued a chargeback on a custom-made, no-refunds item. Or perhaps the customer disagreed that your company performed a service to their expectations, while you feel that you satisfied the requirements of the sale. In more sinister scenarios, some customers may engage in “friendly fraud” and issue a chargeback for a purchase they made and received the good or service as expected, intending to receive their item for free at your expense.

In any case, if you plan to fight a chargeback, you’ll need to do so through your credit card processor. Each processing company has their own method for notifying you of chargebacks and helping you fight them. That’s why it’s important to know what to expect and which processing companies are the best at handling chargebacks.

Fighting a chargeback is known as representment.

The Chargeback Process

Once you receive a chargeback, you’ll have the option to fight it. You’re not required to dispute a chargeback, and in some cases, you may decide it’s not worth the time or effort. If you decide to dispute it, you’ll need to collect supporting documentation to submit as evidence of your claim that the purchase was completed satisfactorily.

Notification

Your processor will notify you of a chargeback and immediately deduct the amount of the disputed transaction from your bank account. Note that this does not mean you’ve already lost the chargeback. If you’re found to be in the right, you’ll receive that money back.

Some processors notify you of chargebacks by mail while others do it by email or an online processing dashboard. Be sure that your processor has your correct address and email address, and that you regularly check your spam folder. Chargebacks are time-sensitive, so delays in responding can mean you’ll lose by default, without even presenting your side.

Chargeback notifications may also be called “chargeback advice,” “chargeback adjustment advice,” and other variations, so be sure to read all documents with variations of those words.

Chargeback Advice

In the chargeback advice notification, your processor will include details of the disputed transaction. This will usually include the chargeback reason code, the transaction amount, date by which you’ll need to respond, and details that identify the transaction. It may also suggest supporting documents to submit if you intend to fight the chargeback.

The customer’s bank will usually provide a letter detailing what documents it wants you to provide. Be sure to adequately address all of the requests for the best chances of a successful chargeback dispute. If you’re unsure of what to provide or need assistance gathering specific information, check with your processor.

How long do I have to respond to a chargeback?

Typically, 14 days. Your processor will inform you of the date by which you’ll need to respond. It’s important that you don’t miss this window. Some processors may give you a shorter timeframe in order to ensure that they receive all of your information with adequate time to submit it on your behalf.

Compelling Evidence

In chargebacks, “compelling evidence” is documentation or proof that you fulfilled your obligations to the customer. The evidence must be something more than your word, but what you provide varies. Examples of compelling evidence include proof of delivery, copies of receipts / invoices / order forms, contracts with signatures agreeing to terms and pricing, and other documents that clearly detail the customer’s order and their approval of the transaction. In some cases, emails or other correspondence expressing satisfaction with a purchase may help.

If you use fraud tools such as AVS or 3D Secure, proof of use and of shipping to an AVS matched address can also help your case.

Visa’s chargeback guide for merchants includes a table on types of compelling evidence for different situations.

AVS and 3DSecure

Proven use of anti-fraud tools can also aid in a chargeback rebuttal. Both can show that you took steps to prevent fraud and comply with card brand rules and best practices. However, you’ll need to have these tools in place and working before you get a chargeback. They cannot be applied retroactively.

Address Verification

Address Verification System (or Address Verification Service) is a fraud-prevention measure you can use during transactions. When used correctly, it can also serve as compelling evidence in a chargeback dispute.

The system will check that the address the cardholder enters during a purchase matches the billing address on file with the credit card company of the card being used. AVS returns a “code” letting you know if the addresses match completely, match partially, or don’t match at all. This code is the crucial component in chargeback defense. If you ship to an AVS-match address, you’ll have a better shot at succeeding in your chargeback dispute. If you shipped to a partially-matching or non-matching address, you’re unlikely to win your dispute.

AVS code results are stored with other transaction details, meaning you can retrieve them after the transaction has taken place in order to use it as evidence that you received a code indicating an address match. You can check with your processor or gateway provider for information on locating an AVS code in a completed transaction.

3D Secure

Both Visa and Mastercard offer “3DSecure” programs, which involves extra layers of security for online transactions. While the programs originally required customers to enroll in advance and enter a password in a popup window, newer versions are more streamlined.

The main benefit to 3DSecure is the potential liability shift. Both Visa and Mastercard state that if a transaction is approved while you’re using 3DSecure, liability for fraud may lie with the issuer instead of you. Verified by Visa and Mastercard SecureCode are viewed as higher levels of verification, so it may be determined that a fraudulent transaction that gets through those systems is not your fault.

Visa Chargeback System

In April of 2018, Visa announced updated guidelines for dispute resolution. The card brand wanted to respond to increased friendly fraud as well as provide a more effective system for the modern payments landscape.

The result is an updated Visa Claims Resolution system, an attempt to balance cardholder protections and business protections. The system includes tools to help cut down on invalid chargebacks while still allowing a manual rebuttal system. Visa also consolidated chargeback reason codes.

Visa Claims Resolution (VCR)

As noted above, Visa Claims Resolution (VCR) is the name for Visa’s overall chargeback management system. It’s comprised of Visa Response Online (VROL), an online dashboard for chargeback management, which works with the Visa Merchant Purchase Inquiry (VMPI) tool.

The VROL component is the official Visa channel for providing information about chargebacks, and Visa requires that processors use it.

Since the VCR system has many different components (and costs) we’ve covered it in greater detail in a separate article. Read more about Visa Claims Resolution.

Chargeback Fraud

In addition to updated tools, Visa placed a limit of 35 card-not-present disputes that a cardholder can make from a single account over the course of 120 days. While Visa does not require issuing banks to close a cardholder’s account after the cardholder reports fraud, not closing it will prevent that bank from initiating a fraud dispute for that account on future transactions, across all businesses.

Despite Visa’s new tools and the limits on disputes, many businesses find that friendly fraud is still difficult to prove. Your best defense is to ensure you’re properly utilizing anti-fraud tools and collecting documentation along the way, even when a transaction seems normal.

Mastercard Chargeback System

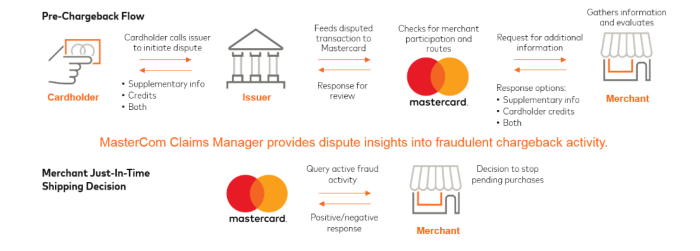

Mastercard also updated its systems to offer more advanced features in 2018. Where Visa has VROL, Mastercard uses MasterCom, an electronic system that offers dispute assistance. Like VROL, it includes electronic retrieval requests, automating the initial pre-chargeback dispute phase to help minimize the disputes that actually progress to chargebacks. As you can see from this graphic from Mastercard’s documents on MasterCom, the system functions similarly to VMPI in that it checks with the merchant for important information before a chargeback occurs.

The system also maintains a chargeback history to help monitor chargebacks over time. Processors must use the Case Filing application within MasterCom to respond to chargebacks on your behalf.

Issuers and acquirers use MasterCom to manage disputes and chargebacks. Your processor will submit supporting documents through MasterCom if you fight a chargeback.

Like VROL, MasterCom is a system for issuers and processors. So while your business may benefit from its use, it’s not a platform that you’ll access directly. Rather, your processor will use it on your behalf.

Chargeback Verdict

Once your processor provides supporting documents to the customer’s bank, they will review all of the information as well as the details from their customer and determine whether the chargeback is warranted or not.

It may sound unfair that the customer’s bank gets to make the determination. To help with that, the card brands offer an arbitration process where you can appeal directly to the card brand itself.

Card Brand Arbitration

Either party (you or the issuing bank) can choose to pursue arbitration after the bank’s chargeback determination. If you lose the initial chargeback determination, you’ll have the option to appeal it directly to Visa or Mastercard. If your customer loses the chargeback but disagrees with the bank’s decision, they can also pursue arbitration.

However, there’s a big drawback: arbitration costs a few hundred dollars. Unless the sale is in the thousands, it may cost you more to pursue arbitration than the original amount you would have received from the customer. You’ll also need to go through the process of submitting documents again.

Additionally, some aggregators (such as Stripe) appear to not allow appealing a chargeback ruling. We’ve reached out to Stripe to confirm.

Arbitration Timelines

For Visa, your processor will have 10 days after the chargeback determination to file for arbitration.

For Mastercard, your processor has 45 days.

In either case, your processor will send you a letter explaining the option for arbitration. If you intend to pursue arbitration, be sure to respond to your processor ASAP so that they don’t miss deadlines for filing. Your processor will also need to provide supporting documents before the filing deadline.

Arbitration Costs

Both Visa and Mastercard charge for card brand-level arbitration.

Visa Fees

While Visa has thorough guides that include information about chargebacks and arbitration, the company doesn’t disclose specific fee amounts for arbitration. Instead, Visa simply notes that the party found responsible will pay:

- Filing fee

- Review fee

Additional technical violation fees can be charged to either party at Visa’s discretion if they’re found to not comply with the arbitration rules. One important Visa rule is that you cannot submit documents in arbitration that you haven’t provided to the opposing party already.

Visa and Mastercard tend to charge similarly for other things in processing, so it’s not unreasonable to assume that Visa’s arbitration fees would be similar to Mastercard’s. You can likely expect fees in the hundreds.

Mastercard Fees

According to Mastercard’s chargeback guide, the card brand charges a few different fees during arbitration. The company charges a filing fee as well as a fee for the final ruling from the Dispute Resolution Management team. The party that initiates the filing will typically pay the filing fee, whether that’s you or the cardholder/bank. If either party withdraws the filing before it reaches the Dispute Resolution Management team, the withdrawing party will pay a withdrawal fee of $150.

A case that goes to the Dispute Resolution Management team for resolution will result in the following Mastercard fees, paid by the party found responsible:

- Filing fee: $150

- Administrative fee: $250

An additional Technical Violation Fee for violations of the dispute process rules may apply to either party. Technical violations cost $100 per violation.

Appealing Arbitration

Mastercard allows one additional appeal to the arbitration ruling, but that will cost you another $500 to appeal and you cannot provide additional information unless it’s specifically requested. Instead, you’ll simply explain why you believe an appeal is warranted.

Visa allows one additional appeal only if the dispute concerns a transaction of $5,000 or more and there’s new evidence that was not available during the previous arbitration. In that regard, the two are complete opposites: Mastercard doesn’t allow new information in an arbitration appeal, while Visa requires it as a condition of being permitted to appeal.

However, given the costs of arbitration and appeals, it’s often not worth the expense to continue to appeal a case that you’ve lost in previous rulings, especially for lower value transactions. Appeal may be worthwhile for unusually large transactions.

If a customer wins a chargeback or arbitration, am I out the money and the product?

Not necessarily.

If a customer keeps an item or you’ve already performed a service, that customer may still owe for that purchase. Losing a chargeback or even an appeal does not inherently mean that the customer doesn’t owe you money.

However, if you lose a chargeback and believe a customer owes you, you’ll usually need to pursue payment in court. Many businesses find that taking a customer to court for non-payment is a time-consuming and expensive process that isn’t always justified by the lost transaction revenue.

If you’re considering options for pursuing a customer after losing a chargeback or appeal, consult a licensed attorney in your area.

The best defense against chargebacks is strong anti-fraud protections prior to receiving one. Make sure you’re utilizing the latest security technology, especially for your online store. When you do inevitably receive a chargeback, work with your processor to determine the best approach.