Choosing the right merchant services provider (also called a credit card processor) for your business can be the difference between frustration and overpaying or a competitively priced merchant account with great customer service.

The method to go about choosing the right credit card processor is very similar whether you’re taking cards for the first time or switching processors from your existing solution. The only real difference is equipment considerations.

This article will go over what you need to look for (and avoid!) in order to choose a merchant services provider for your business.

- If You’re New to Taking Credit Cards

- If You’re Already Accepting Credit Cards

- How to Choose a Merchant Services Provider: Evaluating Options

- Choosing Credit Card Machines

Businesses that are new to taking credit cards will need a way to accept those cards, while businesses that already accept credit cards must determine if they want to keep their current setup or purchase new systems. Here’s what you need to think about in either scenario.

If You’re New to Taking Credit Cards

Businesses that aren’t currently accepting credit cards should generally find their merchant services provider first and equipment second. Unless you need a specialty feature that isn’t common in credit card machines, it’s in your best interest to secure a low cost merchant account with a credit card processor and then choose from the equipment that the processor can support.

Since processors can offer a wide range of equipment, doing it this way ensures that you get both a machine that fits your needs and the lowest cost for credit card processing.

But what if you need a specialty feature? In that case, find your credit card machine or POS system first – the system that offers the special feature that you need. Specialty features include things like restaurant delivery tracking and online ordering.

Just be aware that when you choose a system first, you may be limited in your choice of processor, which can significantly affect your competitive leverage. You will likely end up paying more for credit card processing if you choose your equipment first.

If You’re Already Accepting Credit Cards

For businesses that are already accepting credit cards, equipment may play a larger role in decisions. You’ll need to determine if keeping your existing system is a priority or if you’re open to purchasing a new machine or using a new online payment gateway.

If you don’t need to continue using the current machines or are due for an upgrade anyway, you don’t need to worry about the existing equipment compatibility and can jump down to the section on evaluating merchant service providers.

If you already have a countertop terminal or POS system and want to keep it:

- Determine if it’s universal, selective, or proprietary

Different credit card machines and POS systems work with different credit card processors. Some systems are universal, meaning they work with any company, while others are proprietary, meaning they work with only one or two processors. Selective systems fall in between – they work with multiple processing companies (often on the same backend platform) but not all.

Examples of universal credit card machines include Verifone and Ingenico models. Popular proprietary machines include Square terminals and PayPal readers. Examples of selective machines include Fiserv (formerly First Data’s) FD line of countertop terminals.

Determine Equipment Status

To find out the status of a system, you can call your processor or check the CardFellow credit card equipment directory and search for your machine.

The reason this matters is that if you want to continue using your current machines, you’ll need to choose a processor that can reprogram your credit card machine.

Note that some systems can’t be reprogrammed even if they do work with multiple processors. Examples of non-reprogrammable machines include the Clover Station POS system and the Vital POS system.

If your system is universal or selective, you can proceed to the steps to choosing a merchant services provider, below. However, if your system is proprietary, you won’t be able to choose a new processor and continue to use the same equipment.

How to Choose a Merchant Services Provider: Evaluating Options

When choosing a merchant services provider, it’s important to know what to look for and what to avoid.

Look for:

- True “pass-through” pricing, also called interchange plus

- Rate locks so that your markup rates won’t increase over time

- Customer service that answers your calls and provides clear answers to questions

Avoid:

- “Tiered” or “bundled” pricing, identified by the terms “qualified” and “non-qualified” rates

- Cancellation fees, especially liquidated damages

Tiered pricing (also sometimes called bundled pricing) is an opaque and easily-manipulated pricing model. We prohibit that type of pricing for CardFellow members.

Ignore:

- “Best Processor” lists

- Reviews

Well, you don’t have to ignore them; but don’t make your entire decision based on credit card processor reviews or best processor lists. The reason is simple: processors set pricing so that it’s specific to each individual business. Furthermore, the way that credit card processing fees work means that some processors or pricing models are a good fit for one type of business and not for another. It’s impossible for anyone to give a general “best processor” list for that reason.

When it comes to reviews, the main thing is that you don’t know whether you’ll get the same pricing and terms as the person leaving the review. A restaurant processing $500,000 / month in credit cards might love the low pricing they got from a particular processor and leave a glowing review. But will your $50,000 / month hotel get the same rates? Probably not.

So, if best processor lists and reviews can steer you wrong, how should you choose a merchant services provider?

Get Specific

Searching online for a credit card processor will bring up a ton of information – an overwhelming amount, in fact. The more specific you can be, the better chance you’ll have of coming across the right fit. Instead of searching for “cheap credit card processors” try, “credit card processors for [your industry].” Searches like “merchant services for restaurants” will at least narrow down the amount of information and give you a better starting point.

From there, you can research the companies you find, get rates and fees, and compare them to other options. You’ll need to be very organized, creating documents to track the information you receive to compare the pricing, terms, and other details. You should also request a copy of any contracts and go through them carefully. Remember, what a salesperson promises doesn’t override what it’s the contract that you sign afterwards.

However, this is the “long” way to do it.

A much simpler way is to consider a wholesale credit card processing club.

Credit Card Processing Wholesale Clubs

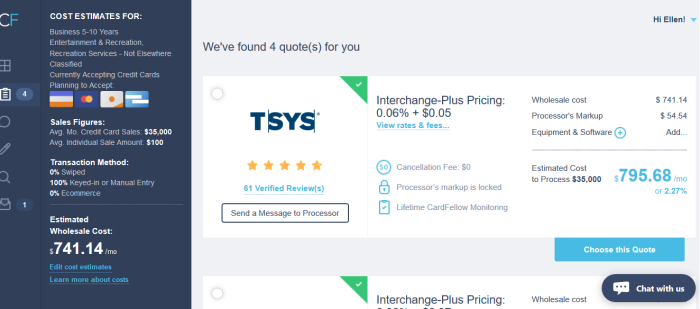

CardFellow operates a credit card processing wholesale club, where you can access exclusive members-only pricing and enjoy additional perks. With a free membership, you get access to custom quotes from multiple processors in a convenient user dashboard.

This dashboard serves as your processor comparison homebase. All of the pricing is in the same format for quick side-by-side comparisons and you can pull in quotes from multiple processors. The screenshot below shows the quick overview page for quotes.

Additionally, you can view pricing in detail, send messages to processors through the anonymous message board, research equipment options, and get independent expert advice.

CardFellow has teamed up with leading processors to offer exclusive members-only deals, but if you want to see quotes from non-member processors, you can do that, too.

If you choose a CardFellow member processor, your free membership benefits include:

- Lifetime rate lock

- No cancellation fees

- Independent, expert statement monitoring

Best of all, membership is absolutely free. No, really! You don’t pay us at any point. Instead, we get a commission from the processors that provide services to our members. Read more about how we make money.

A credit card processing wholesale club like CardFellow is the simplest way to research and compare credit card processing options. If you’re new to accepting cards, save yourself the hassle and start with CardFellow.

If you’ve been accepting cards for years but are sick of getting burned by price increases and auto-renewing contracts, stop the madness once and for all by joining today.

Choosing Credit Card Machines

Deciding on a credit card machine or POS system is the last piece of the puzzle. For business owners that are new to taking cards (or those that willing to replace their current systems) choosing the right equipment is an important step. Once you’ve chosen your processor or have narrowed down your choices to a couple of processors, follow these steps to choose your equipment:

- Make a list of features you require, features you’d like, and features you don’t need.

- Ask the processor(s) which machines they recommend or support.

- Research those machines. CardFellow maintains a credit card processing equipment directory you can use for accurate info.

- Book demos with your top choices based on your equipment research.

- Buy your system. You don’t have to purchase it through your processor, but it’s a good idea, as they will program it for you.

If you choose to purchase elsewhere, be sure to confirm with the processors that they can program the specific model that you’re buying.

Need more information? Check out our article on how to choose a credit card machine for your business.