Originally created in 2004 to streamline 1099 reporting, merchant category codes are now used for a number of different purposes. Of particular importance to businesses is a merchant category code’s impact on interchange fees charged by issuing banks.

We will discuss the finer points of MCCs below.

- What is a merchant category code?

- How are merchant category codes used?

- Why are merchant category codes important?

- MasterCard Merchant Category Codes

- Merchant Category Code List

- MCC Lookup

What is a merchant category code?

A merchant category code (MCC) is a four-digit number assigned to a business by an acquiring bank or institution when the business opens a merchant account to begin accepting Visa or Mastercard as a form of payment.

Merchant category codes have been used to classify businesses by specific market segments since the Internal Revenue Service published IRS Revenue Procedure 2004-43 in Internal Revenue Bulletin 2004-31. For example, a veterinary clinic would be assigned a merchant category code of 0742 for “Veterinary Services.”

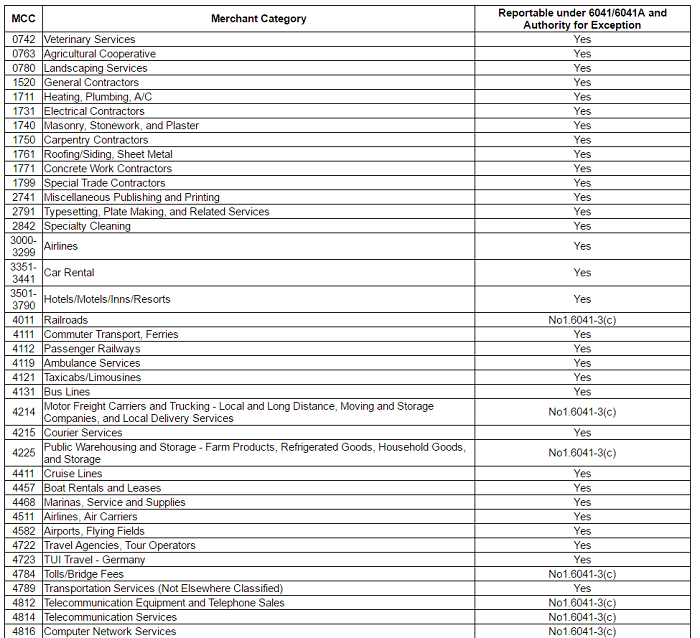

There are quite a few merchant category codes, as seen in this snippet from the IRS list:

How are merchant category codes used?

There are several uses for MCC’s these days.

Merchant category codes were originally created to simplify 1099 reporting for commercial cardholders. The IRS requires businesses to report payments made for services on a year-end 1099 form, but it does not require the purchase of goods to be reported. Prior to MCC classification, cardholders had to sort through transaction-level detail to determine whether a payment card purchase needed to be reported.

With MCC classification in place, cardholders can now reference the MCC of the business where a purchase was made to determine whether the purchase must be reported to the IRS. For example, a payment made to a business classified as MCC 4816 “Computer Network Services” would be reportable because the business provides a service, whereas a payment made to a business classified as MCC 5734 “Computer Software Stores” would not be reportable because the business sells a product.

Since 2004, merchant category codes have come to be utilized for more than simplifying 1099 reporting. For example, acquirers use MCC classification as a measure of risk and to identify prohibited business types, and Visa and MasterCard use merchant category codes to influence interchange fee qualification. That means that the costs you pay for credit card processing are partly influenced by your MCC. I’ll discuss this further in the section “Why are merchant category codes important?”, below.

Some processing companies can’t offer services to businesses with certain MCCs, and some options like charging convenience fees are only available to businesses with particular MCCs.

For HSA and FSA Card Acceptance

Medical practices and healthcare businesses that accept HSA and FSA cards can only do so if they’re correctly classed with a healthcare MCC. Drug stores and pharmacies that sell qualifying products may also accept FSA and HSA cards if they have appropriate MCCs and meet additional requirements. Read more about taking credit cards at a medical practice.

For Consumers

Additionally, on the consumer side, credit card rewards points are sometimes calculated by MCC. When a card offers rewards on a changing set of categories (like 5% on groceries one quarter, 5% on restaurants the next, etc.) the rewards will only be calculated for purchases made at businesses with relevant merchant category codes.

Why are merchant category codes important?

Aside from cardholder reporting, merchant category codes are used by the major card brands (Visa, Mastercard, Discover and American Express) to influence the interchange fees that a business pays.

If you’re not sure what interchange fees are, take a moment to read up interchange fees here. Interchange fees are important because they are collected by banks that issue credit and debit cards, and they account for the vast majority of a business’ credit card processing expense.

Businesses with certain merchant category codes may qualify for interchange rates that often lead to lower than typical credit card processing charges.

For example, a business classified as 5411 “Grocery Stores, Supermarkets,” 8211 “Elementary and Secondary Schools,” or 6300 “Insurance Sales and Underwriting” will qualify for lower than typical interchange categories.

It’s important to note that most merchant category codes will not qualify a business for lower interchange rates, and some MCCs qualify a business for industry-specific interchange rates that are different than typical rates, but not necessarily lower.

However, it’s important to ensure that your business is correctly classified both for reporting purposes and to ensure it does not lose out on potentially lower rates.

Can I get set up with a different MCC to get lower rates?

No. Your business must be classified with the correct MCC. There are situations where two or more MCCs might apply to one business, such as a restaurant that also has a sit-down bar. In those cases, factors like which aspect of the business accounts for more of your total sales will be taken into account, meaning your restaurant could be classed as a bar or vice-versa. It wouldn’t be possible for your restaurant to be classed as a supermarket to take advantage of lower grocery interchange rates.

However, if you’re paying too much for credit card processing, you can easily see if you’re eligible for lower costs by using this free quote comparison tool.

Mastercard Merchant Category Codes

Mastercard uses the same merchant category codes referenced by the IRS and other payment brands such as Visa, Discover and American Express. However, Mastercard uses an additional transaction category code (TCC) to further identify general business categories.

MasterCard’s TCC codes are as follows:

| A | Automobile/Vehicle Rentals |

| C or Z | Cash Disbursement |

| F | Restaurant |

| H | Hotel/Motel |

| O | College/School Expense |

| O | Hospital |

| P | Payment Service Provider |

| R | All Other Merchants/U.S. Post Exchange |

| T | Pre-Authorized Mail/Telephone Order |

| U | Unique Transaction Quasi-Cash Disbursement |

| U or R | Cardholder-Activated Terminal |

| X | Airline, Railroad, Travel Agency/Transportation |

Merchant Category Code List

Several resources are available online that provide a merchant category code list. We have listed a few of these resources below: