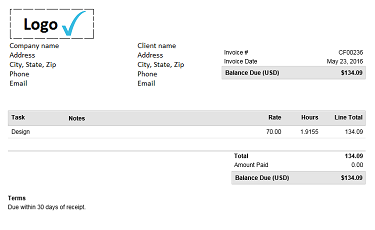

Employees with expense accounts pay for business-related goods and services with the understanding that they’ll be reimbursed. It makes things easier for staff members who travel, entertain clients, or otherwise need to spend money in order to bring sales and profits to your business. The more profit you can get out of your business the […]

Expense accounts are financial allowances offered to particular employees to cover business expenses. But they’re also a common place to “leak” cash, and if you’re not careful, they could be costing you.