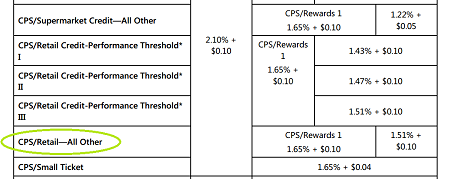

In order to understand CPS, you need to understand the fundamentals of interchange and interchange qualification. I’ll briefly cover them in this article. If you’re interested in learning more, which I encourage, check out related articles on the topics of interchange and processor pricing models on CardFellow’s blog. Note: As of summer 2023, Visa has […]

CPS is an acronym associated with some Visa interchange categories. It stands for Custom Payment Service.

In a nutshell, Visa’s CPS allows a business to qualify transactions to an interchange category with a lower rate by following a set of rules.