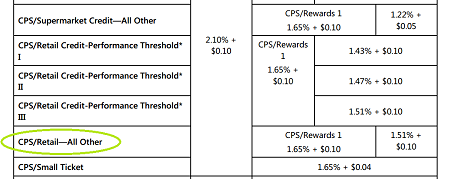

The CPS Card Not Present interchange category that is used to calculate the interchange fee for card-not-present transactions involving a payment made with a traditional consumer credit card (instead of rewards, business or government cards) taken by mail or over the phone.

CPS card not present categories refer to Visa interchange rates that apply to many basic online and keyed transactions.